Investor blogs and podcasts

In Kesko’s investor blogs and podcasts, Kesko’s management discusses topical issues relevant to investors and shareholders.

”To turn market share in grocery trade around, we focus on price, quality and our store network” – an interview with grocery trade President Ari Akseli

The President of Kesko's biggest division, grocery trade, Ari Akseli was a guest on the popular Finnish Karon Grilli investor interview series in November 2025. In the interview, Akseli and author/journalist Karo Hämäläinen discussed, among other things, the actions Kesko has taken to turn around its market share development in grocery trade, the role of private label products, and the growing retail media business.

Key themes discussed in the interview are summarised in this blog post. The original Finnish-language interview can be found on Youtube here.

Measures taken to turn market share around are yielding results

Kesko’s strategic objective in grocery trade is to improve its market share. In recent years, the market share has decreased, totalling 33.7% in 2024 (source: Nielsen). According to Ari Akseli, Kesko has initiated various measures to address the trend, making notable investments in prices and in updating its store network, while also ensuring that the stores uphold a level of quality that sets them apart from the competition.

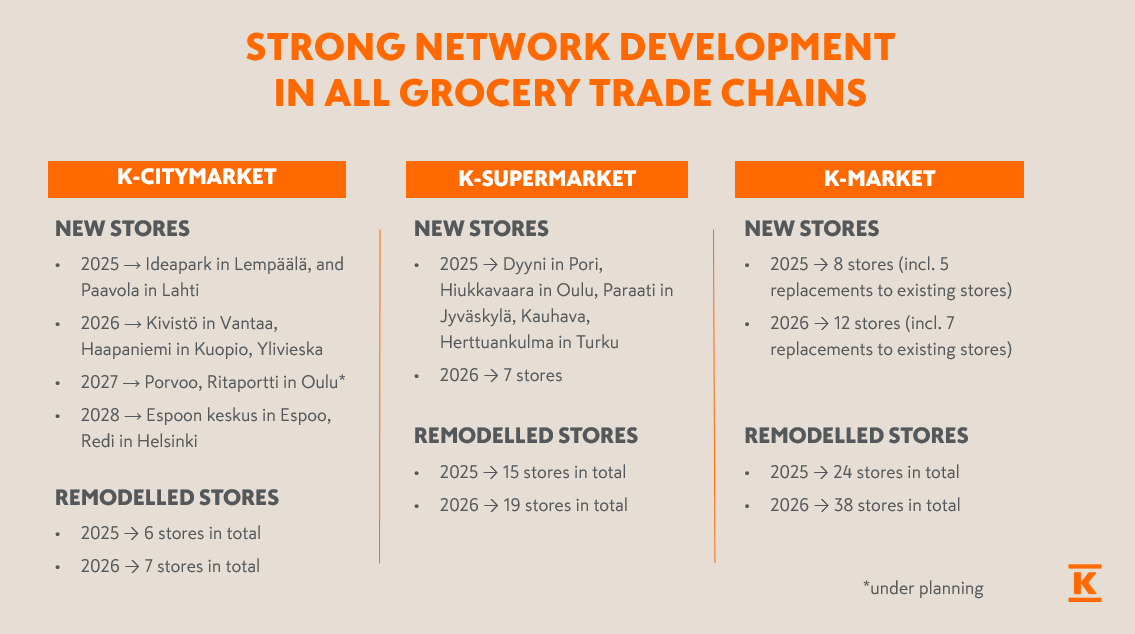

Investments in the store network: In recent years, Kesko has invested notably in developing its network of grocery stores, especially in the hypermarket segment, where growth in Finland is the strongest. Kesko did not open any new hypermarkets between 2018 and 2023, partly due to Covid-related uncertainty, says Akseli. However, now there are several new K-Citymarket stores in the pipeline, located in urban growth centres. Most recently Kesko announced plans for new hypermarkets in Helsinki, Espoo and Vantaa. Ari Akseli notes that Kesko has won over market share in the hypermarket segment this year, and done well in the supermarket segment, while in the neighbourhood store segment, focus has been on ensuring a healthy and viable store network.

Investments in store prices: Kesko’s approach to price is described by Ari Akseli as follows: keeping the prices of everyday basics at a level that does not form an obstacle for customers, having the best discounts and offers in the market, and offering a variety of targeted customer-specific benefits based on purchase data. At the start of the year, K Group reduced prices on over 1,000 branded and private label products. This represented a notable joint investment by Kesko and the K-retailers as well as suppliers wishing to increase their volumes and market share. Akseli notes that in the third quarter of 2025, price increases in K Group grocery stores were clearly more moderate than the overall market increase.

Although operating profit for Kesko’s grocery trade has decreased this year, Akseli argues that the division’s profitability remains good. There are costs related to the investments made in price and store network development, but those investments are expected to support sales growth going forward. Kesko’s current guidance says that comparable operating margin for the grocery trade division is estimated to stay clearly above 6% also in 2026.

K-retailers lend a competitive advantage for Kesko

When asked about the collaboration between Kesko and K-retailers, Ari Akseli notes that the retailers lend a significant competitive advantage for Kesko. They uphold the quality of the stores, as each retailer wants to maximise customer satisfaction and sales in their store. Retailers are also able to respond immediately to any changes in the market, and communicate related needs to Kesko directly. In turn, Kesko strives to support the retailers’ profitability by offering tools and solutions that help them e.g. optimise their selections, reduce product waste, and increase customer satisfaction, average purchase and sales mix. According to Akseli, cooperation between Kesko and the retailers is good and has been tightened further in recent years. He says that the retailers also understand the need for price investments and why Kesko needs to maintain a good level of profitability in grocery trade – the latter enables necessary investments in the store network and in the development of grocery trade IT systems and logistics.

Private label products complement store selections – focus on specific product categories in hypermarket non-food trade

Private label products have been a hot topic in Finland recently, although their share of grocery sales (some 20%) is much lower than in many other European countries. For K Group, Ari Akseli explains, it is important to offer a wide selection of both branded and private label products at various price points. He notes that Kesko often works together with suppliers in developing new products for Kesko’s private label ranges, and such collaborations may benefit the supplier by enabling them to increase production capacity, for example. The current Finnish government has been critical towards private labels and is considering introducing restrictions on e.g. the display of private label products in its amended Food Market Act. Ari Akseli notes that in K Group stores, product placement is based on customers easily finding their favourite products, thus avoiding unnecessary food waste. Should there be restrictions on private labels, Akseli would not expect them to weaken Kesko’s profitability: however, customers could see their grocery bills go up. Kesko’s private labels – Pirkka, Pirkka Parhaat and K Menu – are very popular among customers. They also help increase customer loyalty: annual average purchase is doubled among customers buying Pirkka Parhaat products. A new concept for flower sales is currently being rolled out in K-Citymarket stores, and the results have been very promising.

Kesko’s private labels – Pirkka, Pirkka Parhaat and K Menu – are very popular among customers. They also help increase customer loyalty: annual average purchase is doubled among customers buying Pirkka Parhaat products. A new concept for flower sales is currently being rolled out in K-Citymarket stores, and the results have been very promising.

The non-food trade in K-Citymarket hypermarkets is a profitable business for Kesko, even though the level is not at the same record heights as during the pandemic. Akseli explains that of the non-food sales, approximately half comes from steady “near food” items, such as detergents and personal hygiene products. The rest comes from the sales of clothing, home supplies, sports equipment, consumer electronics and flowers. Kesko has made choices regarding focus areas in non-food selections: for example, in clothing, focus will be more on everyday items such as socks and underwear. A new concept for flower sales is currently being rolled out, and according to Ari Akseli, it has resulted in double-digit sales growth.

Retail media is a growing profitable business

Entirely new business is also being introduced alongside traditional grocery trade operations. Retail media is a growing, profitable business area that allows partners to market their products and services in Kesko’s channels, such as the K-Ruoka website and mobile app and digital instore displays. Marketing production costs are low compared to traditional media, and results easily and immediately measured through product sales. Ari Akseli notes in the interview that media sales amount to tens of millions of euros at the moment, and that demand for retail media services is growing fast.