Dividend policy and dividend

Dividend policy

In the long-term, Kesko aims to distribute a steadily growing dividend of some 60-100% of its comparable earnings per share, taking into account the company’s financial position and strategy.

Dividend in 2025

The Annual General Meeting held on 24 March 2025 resolved to distribute, based on the adopted balance sheet for 2024, a dividend of €0.90 per share on shares held outside the company at the date of dividend distribution. The remaining distributable assets will remain in equity. The dividend will be paid in four instalments as follows:

-

The first instalment of €0.23 per share is to be paid to shareholders registered in the company's register of shareholders kept by Euroclear Finland Ltd on the instalment’s record date 26 March 2025. The dividend instalment pay date is 2 April 2025.

-

The second instalment of €0.22 per share is to be paid to shareholders registered in the company's register of shareholders kept by Euroclear Finland Ltd on the instalment’s record date 15 July 2025. The dividend instalment pay date is 22 July 2025.

-

The third instalment of €0.23 per share is to be paid to shareholders registered in the company's register of shareholders kept by Euroclear Finland Ltd on the instalment’s record date 14 October 2025. The dividend instalment pay date is 21 October 2025.

-

The fourth instalment of €0.22 per share is to be paid to shareholders registered in the company's register of shareholders kept by Euroclear Finland Ltd on the instalment’s record date 13 January 2026. The dividend instalment pay date is 20 January 2026.

The Board was authorised to decide, if necessary, on new dividend payment record dates and pay dates for the second, third and/or fourth instalments, if the rules and statutes of the Finnish book-entry system change or otherwise so require, or if the payment of dividends is prevented by laws or regulations applied.

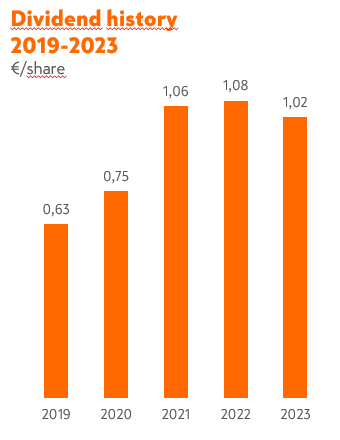

Dividend in 2024

The Annual General Meeting held on March 26, 2024, resolved to distribute a dividend of €1.02 per share be distributed for the year 2023 based on the adopted balance sheet on shares held outside the company at the date of dividend distribution. The remaining distributable assets will remain in equity. The Board proposes that the dividend be paid in four instalments as follows:

- The first instalment of €0.26 per share is to be paid to shareholders registered in the company's register of shareholders kept by Euroclear Finland Ltd on the instalment’s record date 28 March 2024. The dividend instalment pay date is 9 April 2024.

- The second instalment of €0.25 per share is to be paid to shareholders registered in the company's register of shareholders kept by Euroclear Finland Ltd on the instalment’s record date 16 July 2024. The dividend instalment pay date is 23 July 2024.

- The third instalment of €0.26 per share is to be paid to shareholders registered in the company's register of shareholders kept by Euroclear Finland Ltd on the instalment’s record date 15 October 2024. The dividend instalment pay date is 22 October 2024.

- The fourth instalment of €0.25 per share is to be paid to shareholders registered in the company's register of shareholders kept by Euroclear Finland Ltd on the instalment’s record date 14 January 2025. The Board dividend instalment pay date is 21 January 2025.

The Board was authorised to decide, if necessary, on new dividend payment record dates and pay dates for the second, third and/or fourth instalments, if the rules and statutes of the Finnish book-entry system change or otherwise so require.

Dividend in 2023

The Annual General Meeting held on 30 March 2023 resolved to distribute a dividend of €1.08 per share for the year 2022 based on the adopted balance sheet on shares held outside the company at the date of dividend distribution. The dividend will be paid in four equal instalments of €0.27 per share.

- The record date of the first dividend instalment is 3 April 2023 and the pay date 12 April 2023.

- The record date of the second dividend instalment is 21 June 2023 and the pay date 28 June 2023.

- The record date of the third dividend instalment is 12 September 2023 and the pay date 19 September 2023.

- The record date of the fourth dividend instalment is 12 December 2023 and the pay date 19 December 2023.

The Board was authorised to decide, if necessary, on new dividend payment record dates and pay dates for the second, third and/or fourth instalments, if the rules and statutes of the Finnish book-entry system change or otherwise so require. The remaining distributable assets will remain in equity.

Changes in withholding taxation of dividends

Foreign holders of nominee registered shares

Finland has changed the withholding tax laws applicable on dividends paid to holders of nominee registered shares as of 1 January 2021.

In practice this means that withholding tax of 35% will, as a starting point, be levied on Finnish source dividend payments made on nominee registered shares held by non-Finnish tax residents. However, a lower withholding tax rate may be applied, if a custodian has registered with the Tax Administration’s Public Register of Authorised Intermediaries and has advised of a lower withholding based on the required additional information collected by them.

It is possible to apply for a reclaim from the Finnish Tax Administration of any tax withheld in excess of the applicable withholding tax rate (e.g. applicable tax treaty rate). The reclaim can be made after the year of the dividend payment. Reclaim application can be submitted to the Finnish Tax Administration either on paper (form for corporate entities here, and for individuals here) or electronically.

You may also be able to receive a refund already during the year of dividend payment via your registered custodian. Please contact your custodian for further information on the so called quick refund procedure.

Additional information on withholding tax reclaims can be obtained from the Finnish Tax Administration either:

- by e-mail whtreclaims@vero.fi (for corporations only); or

- via the Tax Administration’s general telephone and chat helplines (for both individuals and corporations)

Please note that Kesko does not process applications for withholding tax reclaims nor respond to enquiries regarding withholding taxes.

Finnish holders of nominee registered shares

Dividends paid to Finnish tax resident holders of nominee registered shares may as of 2020 have been subject to withholding of 50% tax prepayment (ennakonpidätys). Any excess tax prepayment is credited in the normal tax assessment process, where the shareholder reports their dividend income to the Finnish Tax Administration.