Financial position

Debt and financing

Key figures

|

10–12/2025 |

10–12/2024 |

1–12/2025 |

1–12/2024 |

|

|

Net sales, € million |

3,230.9 |

3,040.6 |

12,474.7 |

11,920.1 |

|

Operating profit, comparable, € million |

174.6 |

170.8 |

654.9 |

650.1 |

|

Operating margin, comparable, % |

5.4 |

5.6 |

5.3 |

5.5 |

|

Operating profit, € million |

160.1 |

121.0 |

631.3 |

579.5 |

|

Profit before tax, comparable, € million |

144.2 |

143.3 |

533.8 |

543.0 |

|

Profit before tax, € million |

129.4 |

93.1 |

510.3 |

471.5 |

|

Cash flow from operating activities, € million |

292.5 |

301.0 |

879.7 |

1,008.2 |

|

Capital expenditure, € million |

139.5 |

109.0 |

735.7 |

675.9 |

|

Cash flow from investing activities |

-63.2 |

-121.4 |

-541.8 |

-597.5 |

|

Cash flow from financing activities |

-160.5 |

73.2 |

-644.7 |

-149.8 |

|

|

31.12.2025 |

31.12.2024 |

||

|

Liquid assets |

166.2 |

488.1 |

||

|

Interest-bearing liabilities |

3,572.6 |

3,396.3 |

||

|

Lease liabilities |

2,097.5 |

2,051.0 |

||

|

Interest-bearing net debt excl. lease liabilities |

1,308.9 |

857.2 |

||

|

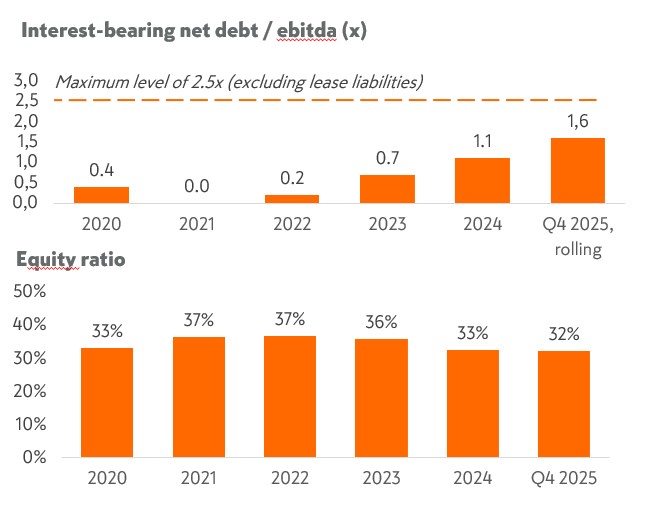

Interest-bearing net debt/EBITDA, excl. IFRS 16 impact, rolling 12 months |

1.6 |

1.1 |

||

|

Gearing, % |

120.5 |

106.3 |

||

|

Equity ratio, % |

32.2 |

32.5 |

Solid financial position

- At the end of Q4/2025, interest-bearing net debt excluding lease liabilities was €1,309m with lease liabilities amounting to €2,098m

- Lease liabilities consist mainly of long-term real estate leases in relation to store sites

- Net debt / EBITDA excluding IFRS 16 was 1.6x and gearing 120,5%

- The Group is committed to a maximum net debt / EBITDA ratio of 2.5x, excluding the impact of IFRS 16

- Kesko’s strong balance sheet enables organic investments and acquisitions in line with the strategy

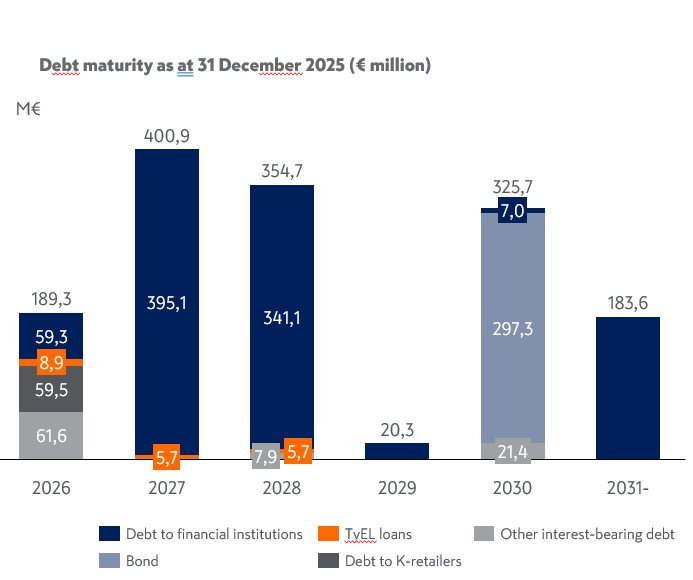

Maturity profile and key financing agreements

Instruments in use:

- Debt to financial institutions, generally term loans to Kesko represent the majority of the “Debt to financial institutions” (in 2026 0M€, in 2027 350M€, in 2028 300M€, and in 2031 150M€)

- Kesko Bond 2030: 300M€

- TyEL loans (FI: TyEL takaisinlainat)

- Debt to K-retailers (FI: tilivelat K-kauppiaille/ennakkomaksut)

Available financing sources (excl. cash flow from operations):

- CPPs 513M€ in total

- RCFs (committed)* (FI: luottolimiitit (komittoidut)), 400M€

*RCFs extend to (conditions apply):

-

- 50M€ to 2027+1yr+1yr

- 100M€ to 2028+1yr

- 100M€ to 2030

- 100M€ to 2030+1yr

- 50M€ to 2030+1yr+1yr

Maturities of financial liabilities 31.12.2025 (excluding lease liabilities)

| <1 year | 1-5 years | > 5 years | Total | |

| Borrowings from financial institutions | 59,4 | 763,6 | 183,6 | 1 006,6 |

| Notes | 0,0 | 297,3 | 0,0 | 297,3 |

| Pension loans | 8,9 | 11,5 | 0,0 | 20,3 |

| Payables to K-retailers | 59,5 | 0,0 | 0,0 | 59,5 |

| Other interest-bearing liabilities | 61,6 | 29,3 | 0,0 | 90,8 |

| Total | 189,3 | 1 101,6 | 183,6 | 1 474,6 |

Contact details for credit analysts covering Kesko can be found here

Kesko’s green notes

Kesko Corporation announced its decision to issue green notes of EUR 300 million on 25 September 2024. The Notes mature on 2 February 2030 and they carry annual interest of 3.500 percent. The issue price of the Notes is 99.317 percent. The yield is 3.646%.

Read more in the listing prospectus of the Notes.

Stock exchange releases about the green notes were published on 20.9.2024, 25.9.2024 and on 2.10.2024. Read more on stock exchange releases.

Kesko Green Bond Annual Review 2024

Sustainability-linked loan with the Nordic Investment Bank

Kesko has signed a €150 million 7-year sustainability-linked loan with the Nordic Investment Bank (NIB), where the interest rate margin is tied to the attainment of certain sustainability targets set for greenhouse gas emissions and food waste. The loan will support Kesko’s ambition to minimise impact on the climate and nature through its own operations and its value chain. At the end of June 2024, more than half of all Kesko loans were sustainability-linked.

Read more in the investor news release

Green finance framework

Kesko has established a Green Finance Framework applicable for the issuance of green debt instruments to further integrate its ambitious sustainability targets into its financing.

Kesko’s Green Finance Framework has received a second-party opinion from Sustainalytics to this Framework, verifying its credibility, impact and alignment with the ICMA and LMA/APLMA/LSTA Principles. Danske Bank acted as advisor on the establishment of the framework.