TCFD report

1. Introduction

Task Force on Climate-Related Financial Disclosures

TCFD stands for the Task Force on Climate-Related Financial Disclosures. It is a framework that organizations can use to publicly disclose the climate-related risks and opportunities to their businesses. It was first published in 2017 and updated in 2021.

The Financial Stability Board established the TCFD to develop recommendations for more effective climate-related disclosures that could promote more informed investment, credit, and insurance underwriting decisions and, in turn, enable stakeholders to understand better the concentrations of carbon-related assets in the financial sector and the financial system’s exposures to climate-related risks.

The Task Force consists of 32 members from across the G20, representing both preparers and users of financial disclosures.

Kesko’s main strategy and sustainability strategy

Sustainability is a central part of Kesko’s strategy. We promote sustainability in the whole value chain from production to customer choices. We create value extensively for the whole society.

The focus areas of our sustainability strategy are climate and nature, value chain sustainability, responsibility for people, and good governance.

Kesko and K-retailers together form K Group, which is the biggest trading sector operator in Finland and one of the biggest in Northern Europe. As a large operator, we are responsible for doing everything we can to reduce emissions. The biggest emissions from Kesko’s own operations are related to electricity and heat used in properties and fuel consumption in logistics transports.

We are committed to the Paris Climate Agreement objectives of mitigating climate change. We aim to reach carbon neutrality by 2025 and to cut emissions from our own operations and transports to zero by 2030. Besides these Scope 1 and Scope 2 targets, we are also committed to reduce absolute Scope 3 GHG emissions from the use of sold products 17% by 2026 from a 2020 base year. We are also committed to that 67% of our direct suppliers by spend covering purchased goods and services will have science-based targets by 2026.

Kesko’s TCFD framework

As climate change and extreme weather phenomena can impact Kesko’s operations, understanding Kesko’s impact on climate is essential for us. To better cover this challenge, we established, in spring 2022, a working group to examine climate change related risks and opportunities in accordance with the TCFD framework and its four thematic areas: governance, strategy, risk management, and metrics and targets. In the first phase, we focused on our grocery trade operations. During this work, we recognized ten physical risks and fourteen transition risks, as well as ten opportunities. The most material of these risks and opportunities are described in chapter 3 (Strategy) of this report. Finally, Kesko’s climate risk profile is analyzed against different climate scenarios to enable well-justified strategic choices.

Managing climate-related risks is an essential part of our risk management process. We acknowledge that new risks may emerge in subsequent reviews and, accordingly, some old risks may disappear. Also, we will deepen our analysis of the financial impact of the risks and opportunities identified to support our business operations and strategic choices.

2. Governance

Organisational structure and key responsibilities related to climate-related risks and opportunities

Kesko’s organisational structure and key responsibilities around climate-related risks and opportunities are based on Kesko’s risk management governance model and integrated risk management process.

Picture 1. Kesko’s Risk Management Governance Model

Kesko’s Board of Directors guides the Group’s risk appetite, confirms the risk management policy, and processes the Group’s most significant risks at its meetings based on the risk management annual cycle. Identified significant climate-related strategic risks and opportunities are reported to and reviewed by the Board of Directors as part of the Group’s risk reporting process.

The President and CEO is in charge of Kesko Group’s risk management. In this capacity, the President and CEO is supported by the CFO, CARO and Group’s risk management function, as well as its Risk Management Steering Group, which reviews current matters related to risk management and prepares a draft of the Group’s risk management report based on updated risk data from business divisions and common functions strategic and operational risk assessments including periodic climate-related risk assessments. The President and CEO approves the Group risk reports before the Board of Directors risk reviews.

Responsibility for the implementation of risk management lies with the management of business divisions and common functions. The risk management unit coordinates the risk management process and is responsible for centralised risk reporting, as well as identifying risks and determining management measures in cooperation with business divisions and common functions.

In Kesko’s integrated risk management framework, the sustainability unit is primary responsible for identifying, assessing and determining risk mitigation measures for climate-related risks in cooperation with business operations and supported by risk management unit. Identified relevant climate risks and opportunities are integrated into business divisions’ annual strategic and quarterly operational risk assessment processes based on the potential business impact.

The significant climate-related strategic risks and opportunities affecting the strategy planning and implementation are reviewed by the Group Management Board and the Board of Directors as part of Kesko’s strategy review process. The identified operational climate-related risks affecting business objectives are updated periodically and the material risks are reviewed by the Board of Directors’ Audit Committee as part of the Group’s quarterly risk reporting process.

Read more: Risk management and control

3. Strategy

Most material identified climate-related risks and opportunities

Kesko has identified one transitional risk as the most material climate-related risk with the potential to have a substantive financial impact on our grocery trade business.

Due to potential increasing regulation, i.e. EU’s revision of the Energy Performance of Buildings Directive (EPBD), large one-time investments in improving energy efficiency of grocery stores may cause increased cash outflows in the long term, provided that the planned regulation comes into effect. Investments in improving energy efficiency decrease energy consumption in grocery stores.

|

Risk event |

Risk description |

|

| Physical |

Changes in temperature leading to increased energy demand and operational costs |

Changes in temperature can lead to increased energy demand and operational costs (e.g., cooling costs). |

|

Long term effects on supply and price for certain commodities globally |

Changing weather events can affect harvest and lead to lower supply and higher price for commodities such as banana, avocado and coffee globally. Additionally, dependence on certain varieties can increase. |

|

|

Heat waves causing malfunctions to electric appliances |

Climate change will increase heat waves and this can negatively affect for example cooling appliances. Potential malfunctions can lead to higher costs as well as loss of inventory. |

|

|

Extreme weather events leading to electricity blackouts |

Extreme weather events such as floods and storms can lead to electricity blackouts and malfunction of appliances that affect inventory. |

|

|

Floods, snow, heavy rain causing damage to buildings |

Snow and rain can cause damage to buildings - for instance, heavy rain and floods can overwhelm the sewer lines and snow pressure on the roofs create a hazard. |

|

| Transitional |

Investment decisions in the carbon neutral heating |

Low carbon heating solutions will require significant investments, causing potential technology risks in the new technologies. Limited availability of green district and geothermal heating, and higher prices. |

|

Large one-time investments in properties |

Investments related to e.g., properties with long life-cycle and uncertainty in choosing the right technology to invest in. |

|

|

Climate-related litigation |

Increased exposure to climate-related litigation due to increasing regulation and impact of climate change. |

|

|

Value chain due diligence |

Potential EU and national Due diligence regulation extending to the entire value chain. This will extend Kesko’s responsibility/liability in its value chain and require improved transparency and processes to manage and mitigate potential supply chain risks. |

|

|

Higher fuel and energy prices |

Green transition will require a shift towards new energy sources and fuels. Price of fossil fuels will rise due to emission pricing and still limited availability of renewable energy sources. Higher fuel and energy prices can lead to increased operational costs. |

Climate change is also creating opportunities for Kesko’s business while the society undergoes a transition and the demand for low-carbon products and services increases. The main driver of identified business opportunities is the changing customer behaviour – for instance, Kesko’s own climate performance can lead to better competitive position reflecting shifting consumer preferences and increased engagement within the client base. Kesko will face new opportunities to export low-carbon and climate resilient domestic products to new markets as well as by launching new low-carbon brand and expanding the plant-based product selection.

Scenario analysis

In connection to Kesko’s new sustainability strategy, the focus of climate-related risk and opportunity analysis was on grocery trade. The materiality of each identified climate risk and opportunity was first assessed against the baseline scenario, after which Kesko’s operations were analysed against two additional scenarios with strongly declining emissions (scenario 2) and stabilizing emissions (scenario 3) to understand how different future outcomes may impact the grocery trade business. The three adopted scenarios are described below:

1. A baseline scenario

This baseline scenario is built around an assumption that announced global climate strategies and targets are expected to be delivered. This would lead globally to temperature increase of 2.5 to 3 °C from pre-industrial level, which may lead to over 4 °C warming in Finland.

2. Scenario with strongly declining emissions (IPCC RCP 2.6)

This scenario presents a world with strong global climate ambitions and actions, leading to the average temperature increase of 1.5 to 2 °C from pre-industrial baseline, expected to limit the warming to 3 °C in Finland.

3. Scenario with stabilizing emissions (IPCC RCP 6.0)

This scenario presents a world with lacking global climate ambitions and actions, leading to the average temperature increase of 3 to 3.5 °C from pre-industrial baseline, which could mean close to 5 °C warming in Finland.

For transition risks, the analysis is building on applicable transition scenarios by the International Energy Agency (IEA SDS, IEA NZE and IEA STEPS).

The selection of scenarios assumes that the most extreme future projections involving a large-scale increase in coal use or, on the contrary, achieving the 1.5°C target by immediate and drastic emissions reductions are becoming less likely to come to fruition. It is to be noted that even a seemingly slight temperature rise may come with a significant increase in associated adverse impacts on the ecosystems and society. The scenarios presented all involve a distinctive set of key factors while they are found plausible future projections in the context of the latest climate science.

The key findings of the Scenario 2 (strongly declining emissions) analysis are:

Risks: In Scenario 2, the transition risks increase greatly due to implementation of more ambitious policies, rapid technological development and increased stakeholder pressure to apply low carbon solutions. In particular, requirements for value chain due diligence and the related reputational risks are expected to expand due to the rise in climate policy ambition and increased consumer awareness. Additionally, in Scenario 2, transition to innovative low-carbon technologies accelerates and may cause potential technology risks associated with investments in novel technologies. For example, significant investments are needed in carbon neutral heating solutions.

The scale of materialized risks is dependent on the scenario pathway meaning that a disorderly transition involving unexpected changes in policies would entail higher risks to the retail business.

Opportunities: In Scenario 2, changing consumer preferences and behavior increasingly affect the retail business. The Scenario is more attractive for Kesko with a sustainable profile and brings new business opportunities, including, for example, development of new product lines, expanding plant-based product selection, as well attracting sustainable financing with reduced cost of capital.

The key findings of the Scenario 3 (stabilizing emissions) analysis are:

Risks: In Scenario 3, physical climate risks, including extreme weather events, can have potential impacts to Kesko’s business and value chain, especially over the longer term as the actions to stop climate change are insufficient causing accelerating climate crisis. The changing climate can lead to a major change in food production areas globally, causing disruptions in the availability of certain commodities and significant price increase. Global supply chains and logistic routes may face notable changes, affecting Kesko’s business.

In Finland, climate change will lead to e.g. in intense storms with heavy wind, rain, and flash floods as well as prolonged heat spells in the summertime. Climate change physical risks can directly affect infrastructure, including properties and other assets, as well as logistics. Changes in temperature can lead to increased energy demand and operational costs. In addition, extreme weather events can affect agriculture and harvest in Finland, causing disruptions in the supply chains.

Opportunities: In Scenario 3, sustainability and climate are not the major drivers of consumer behaviour and preferences, decreasing business opportunities related to expanding product offering and supporting sustainable consumer choices. In this scenario, climate crisis can cause significant disruptions on the global value chains. Local production in Finland and building resiliency in the local value chains can improve climate resiliency. New export opportunities may rise in the global market, which is increasingly affected by the physical risks of the climate crisis.

4. Climate risks in Kesko’s risk management process

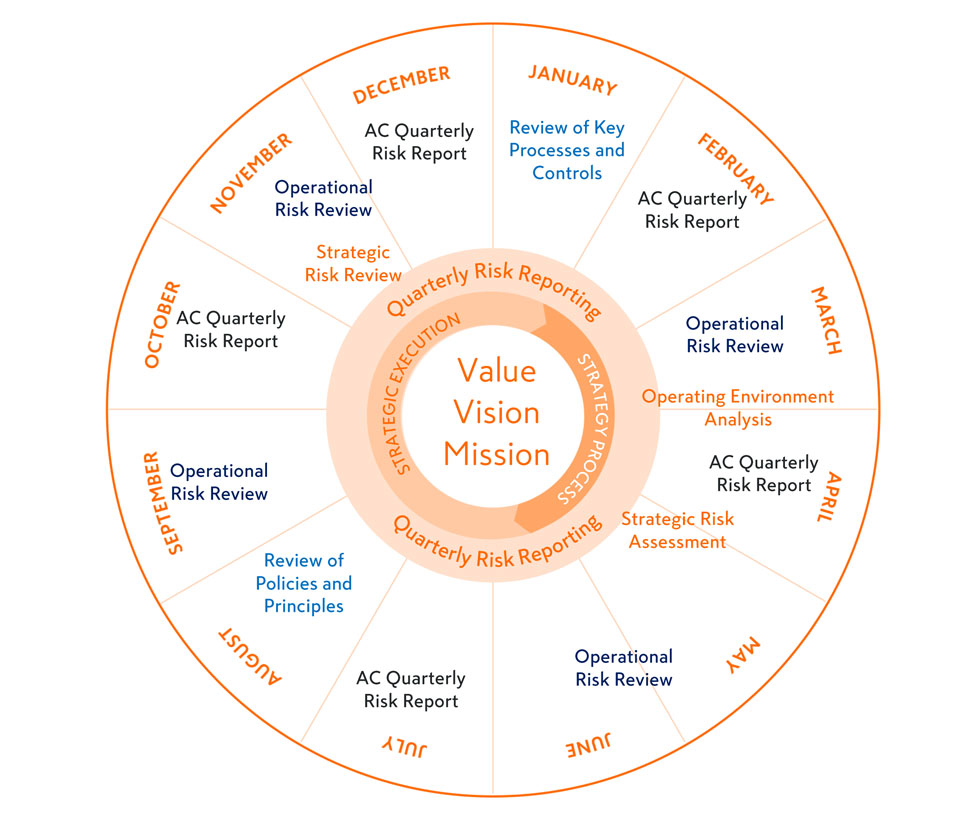

Kesko’s strategic and operational climate-related risks and opportunities are covered in the integrated risk management process. The integrated risk management process is based on the annual cycle that follows Kesko's management model and strategy process.

Picture 4. Risk management annual cycle.

The purpose of the integrated risk management process is to ensure that Kesko’s risk management covers all key risk areas, including climate-related risks and opportunities, and that the comprehensive view of Kesko’s risks is accurate. Its purpose is also to ensure the analysis and distribution of material climate-related risk information between the sustainability unit and the business divisions including the progress of risk management measures across organisational boundaries.

Strategic risks’ likelihood and impact is assessed not only for the strategy period (3-5 years) but also in the long term (over 5 years), using scenarios, simulation and stress testing, and the assessments are updated semi-annually. The operational risks’ likelihood and impact related to achieving strategic targets are assessed in the short term (1-2 years), and the assessment is updated on a quarterly basis by the business divisions and common functions.

Kesko’s climate-related risks and opportunities are identified, assessed and reviewed both in the strategic and operational risk assessment processes. The identified risks are prioritized based on the likelihood of and impact of the risk realization. The focus areas for the climate-related strategic risk and opportunity assessments are decided annually in the sustainability strategy planning process. In 2022, the strategic climate risk assessment focus is on grocery trade division’s potential business critical risks and opportunities.

The climate-related risks and opportunities are identified in a workshop with representatives from the business divisions and relevant common functions dependent on decided focus areas of the risk assessment. The identified physical and transition risks are prioritized based on a likelihood and impact analysis related to chosen climate-change scenarios. The focus of risk management response strategies is in high exposure risks requiring improvement of risk mitigation measures and controls. The identified opportunities are utilized in setting the strategic targets and business objectives.

5. Targets and metrics

Targets

K Group’s aim is to be carbon neutral by 2025. We will systematically reduce emissions to reach zero emissions from our own operations and transports by 2030. During 2025–2030, we will offset our remaining emissions. Our objective is to eventually have no need for offsets and make our own operations emission-free by 2030.

Picture 5. Progress of Climate Neutral K in 2021.

The biggest emissions from Kesko’s own operations are related to electricity and heat used in properties and fuel consumption in logistics transports. The primary means to achieve zero emissions include increased use of electricity and heat produced with renewable energy and switching to biofuels in transports in Finland. We also aim to achieve a 10% increase in energy efficiency by 2023 from base year 2015.

All electricity purchased by Kesko for K-stores and other Kesko properties in Finland has been produced with renewable energy since 2017. Our objective is to increase the share of electricity and heat produced with renewable energy in our other operating countries and in energy purchases made by the retailers.

We also encourage our suppliers to take action to reduce emissions. Our objective is to have science-based emission reduction targets set by 2025 for two thirds of our suppliers by spend covering purchased goods and services. (See chapter 5.3)

Picture 6. Climate impacts in 2021.

Metrics

Annually in our public Sustainability Report, we report the following metrics:

- Energy consumption and use of renewable energy

- Energy efficiency solutions

- Scope 1, Scope 2 and Scope 3 emissions

- Science Based Targets progress

- Share of sustainable products. We define sustainable products as those which have a significantly smaller impact on the climate or biodiversity than comparable products or which are important for adapting to climate change or preventing the loss of biodiversity.

- Sum of sustainable investments. We report investments which decrease emissions from our own operations or emissions caused by our customers’ actions.

Read more: Sustainability Report

Climate action in the supply chain

As a long-time respondent for the CDP Climate Change questionnaire, we decided, in 2021, to join also the CDP Supply Chain program. Our objective is to have science-based emission reduction targets set for two-thirds of the direct suppliers’ emissions by 2025. To reach this target, we challenge at least our approximately 200 largest suppliers in terms of the volume of purchases, who account for two-thirds of our euro-denominated purchases, to reduce their emissions and to report their climate targets and actions through the CDP Climate Change Questionnaire annually. These results are also reported yearly on our public Sustainability Report.

Management remuneration

As part of our sustainability strategy, Kesko’s Board of Directors decided in March 2022 to set sustainability-related criteria for Kesko’s share-based commitment and incentive plans (Performance Share Plans, PSP), i.e. the PSP 2021-2024 and the PSP 2022-2025. In addition to financial indicators, the share award plan includes targets linked to emission reductions and international sustainability indices and assessments. Target groups for the PSP are Group management board, Division management teams, and separately chosen key positions from group common functions.