Frontpage ![]() Year 2010

Year 2010 ![]() Strategic objectives

Strategic objectives

Strategic objectives

Kesko is a highly valued listed trading sector company. It manages retail store chains that are valued by customers, and efficiently produces services for retail store chains' purchasing, logistics, network development and data management. Kesko's operations include the food, home and speciality goods, building and home improvement, and car and machinery trades. Its division parent companies and chains act in close cooperation with retailer entrepreneurs and other partners. Kesko operates in Finland, Sweden, Norway, Estonia, Latvia, Lithuania, Russia, and Belarus.

Profitable growth

- Our objective is to grow faster than market

- We seek growth in nearby areas, particularly in Russia

- We invest in our store network

- We develop e-commerce solutions

- We increase our shareholder value

Sales and services for consumer-customers

- We increase the value of our brands

- Our customer satisfaction exceeds that of our competitors

- Our competitive asset is the K-retailers who know the local customers and their needs

- We use loyal customer information efficiently and commit our customers

Responsible and efficient operating practices

- Our operating practices are responsible

- We efficiently combine retailer entrepreneurship and chain operations

- We leverage our economies of scale and competence for the benefit of customers

- We automate our routines and processes

The objective is profitable growth

Profitable growth

Our objective is to have better sales growth than market and to increase our shareholder value

Kesko's key strategic objective is healthy, profitable growth. In the home market, the objective is to grow faster than market. Growth is also sought in nearby areas, particularly in the fast developing Russian market.

The target return on equity is 12%, while the target return on capital employed is 14%. Our objective is to maintain good solvency in all market conditions.

Capital expenditure in the store network and in strengthening competitive advantages

Kesko seeks growth by strengthening its store network, by implementing projects that give competitive advantage and synergy benefits, and by developing electronic customer communications, including e-commerce.

Capital expenditure in the food trade is directed at expanding and refurbishing the store network in Finland. In addition, the target is to expand business to Russia. The most important project giving competitive advantage in the food trade involves strengthening the selections, service and displays of fruit, vegetable and bakery departments and service counters offering meat, fish and ready-to-eat meals.

In the home and speciality goods trade, synergy benefits are sought by combining purchasing and logistics operations, and chain management. The most important project giving competitive advantage is that designed to increase e-commerce.

In the building and home improvement trade, the store network will be expanded over the next few years in Finland and other operating countries, mainly in Russia. Synergy benefits are achieved by investing in centrally directed sourcing and selections development, and in a joint enterprise resource planning system and logistics network.

In the car and machinery trade, the market shares of the brands represented, such as Volkswagen and Audi, will be increased by developing the retail sales network.

Sales and services for consumer-customers

Kesko is a house of brands

Kesko has dozens of successful chain and product brands. Strategic objectives and a target image have been defined for each brand. The brands are built and managed according to customer needs, taking the K-Group's structure and business models into account. The objective is to increase the value of the brands and to improve the efficiency of marketing. This is systematically measured by customer satisfaction and employer profile surveys, as well as by financial indicators.

The main target group of the chain and product brands owned by Kesko is consumers, whose shopping experiences at the K-stores determine our success in the market.

K-Plussa is the joint customer loyalty system of the K-Group. It is the most extensive and diverse customer loyalty system in Finland, providing K-Plussa customers with benefits at over 3,000 outlets and from more than 40 business partners. Chains and stores utilise customer information in their selection planning, pricing, marketing and store network planning, for example. A key objective is to increase the commitment of K-Plussa customers.

Kesko is primarily the group brand of a listed company. The target groups of the Kesko brand are investors, shareholders, suppliers of goods and services, employees, society in general and all who are in our operating environment. The objective is to increase shareholder value.

Customer-driven business models

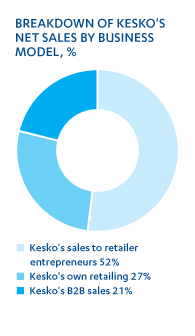

The business models applied in Kesko's sales to consumer-customers are retailing through retailer entrepreneurs and Kesko's own retailing. Kesko is also engaged in B2B sales.

1) Retailer entrepreneurs' retailing

The principal business model in the Finnish market is the chain business model, in which independent K-retailers run retail stores in chains managed by Kesko. In Finland, for example, all food and building and home improvement stores in the K-Group are run by retailer entrepreneurs. Through its chain operations, Kesko provides a first-class setting for its retailer entrepreneurs to provide the best possible service to their customers. The K-retailer entrepreneur implements the chain concept and is responsible for store management, customer satisfaction, the personnel and business profitability. The K-Group's competitive edge derives from its best selections, excellent service and knowledge of customer needs.

At the end of 2010, Kesko had 1,270 K-retailer entrepreneurs as well as about 170 other retailer entrepreneurs in the Asko, Sotka, Byggmakker and Senukai chains as partners. Kesko's sales to the retailer entrepreneurs accounted for 52% of Kesko's net sales in 2010.

2) Kesko's own retailing

Kesko acts as a retailer in business operations where the competitive advantage derives from having a centrally managed chain concept and large units. Kesko's own retail stores in Finland include the Anttila and Kodin Ykkönen department stores. In addition, Kesko is also responsible for retailing home and speciality goods in the K-citymarket chain. Kesko's own retailing is the model mainly used in expanding business operations outside Finland. In 2010, Kesko's own retailing accounted for 27% of net sales.

3) B2B sales

Kesko is also engaged in B2B sales. Typical B2B customers include construction companies, agricultural entrepreneurs, the manufacturing industry, institutional kitchens and the public sector. In 2010, Kesko's B2B sales accounted for 21% of net sales.

Online communications and e-commerce

New online services, wireless solutions and different terminal devices have increased the diversity of customers' needs and purchasing habits. Electronic marketing and interactive customer business models will be a key competitive factor in the near future.

The development of online communications and e-commerce are strategic focal points in all divisions. The objective is that customers will be able, if they wish, to use the K-Group's online services from planning their purchases to using the product.

Kesko is developing its current online stores and services and opening new ones. The objective is to improve customer satisfaction and increase sales. Kesko has gained a strong position in online sales of home and speciality goods through the NetAnttila, Kodin1.com, Konebox.fi, CM-store and Budget Sport online stores.

Customer-driven business models

Responsible and efficient operating practices

Sustainable development and responsible operating practices

The principles of sustainable development and responsible operating practices are a central part of Kesko's and its chains' daily activities. The trading sector is required to take responsibility for product safety and healthiness, and for the environmental and social impact of business operations. The results of responsible operations are reported annually in Kesko's Corporate Responsibility Report.

Efficient combination of retailer entrepreneurship and chain operations, and benefitting from economies of scale

A strategic objective is to efficiently combine K-retailer entrepreneurship and chain operations. The K-retailer entrepreneur implements the chain concept and is responsible for store management, customer satisfaction, the personnel and business profitability.

Kesko's efficient chain operations and joint processes provide support to retailers. Chain operations offer the retailer a joint business concept which includes chain control related to chain selection, pricing and marketing, and business management support. Joint chain operations carried out by retailers and Kesko are further enhanced by developing increasingly better tools and business models for the stores. The most important of these are regional and store-specific selections and pricing guidance as well as tools for customer relationship and store personnel management.

The function of Kesko's purchasing and logistics is to source and deliver products efficiently and at competitive prices. Purchasing is always target-oriented and based on plans. The aim is selections which serve customers best and at affordable prices, while responsible practices are applied. Logistics operations manage the whole supply chain efficiently and provide customers with an optimum on-shelf availability at the lowest possible costs.

Kesko participates in international purchasing cooperation in various product lines, which increases purchasing volumes and efficiency. The most important partnership organisations in which Kesko participates include AMS Sourcing B.V. in the grocery trade, tooMax-x in the building and home improvement trade, Intersport International Corporation in the sports trade, and Electronic Partner International in the home technology trade.

Work and productivity programme

Cost-efficient operations build price competitiveness and customer satisfaction in the retailing sector. Cost-efficiency is also a basic requirement for increasing Kesko's profitability and shareholder value.

The key objective of the work and productivity programme launched is to increase labour productivity in Kesko and the chain stores. The most important tools for improving productivity include enhancing personnel competence and management, and increasing the efficiency of operating practices.

Promoting the wellbeing of employees has become an increasingly important factor. A management model will be built and results measured to improve wellbeing at work. Several projects on work health promotion are underway, aimed at improving the working capacity and motivation of employees, reducing sickness and increasing the retirement age.

Electronic and automated processes

A project to automate processes and routines with the goal of improving cost-efficiency is underway in Kesko. Key areas in process automation include logistics automation projects, the forecasting systems and automated orders that improve the availability of products in stores, the adoption of electronic purchase and sales invoices, and the automation of financial management routines in the shared services centre of the Kesko Group.

More detailed information on each division's strategic emphases and projects is provided in the division-specific presentations.

Financial objectives and their realisation

| Objectives announced on 5 Feb. 2009 |

Target level |

Realised in 2010 |

Realised in 2009 |

| Net sales growth | Growth faster than the market |

Realised*:

Food trade, K-citymarket's home and speciality goods trade, car and machinery trade |

Realised*: Food trade, sports trade, building and home improvement trade (Finland), car and machinery trade |

| Return on equity | 12% | 10.1%, excl. non-recurring items 8.7% |

6.6%, excl. non-recurring items 3.8% |

| Return on capital employed |

14% | 15.9%, excl. non-recurring items 13.9% |

11.0%, excl. non-recurring items 7.3% |

| Interest-bearing net debt/EBITDA |

< 3 | -0.9 | -0.7 |

| Equity ratio | 40–50% | 53% | 54% |

| Economic value added |

Growing positive EVA as internal indicator |

Realised in all divisions,except for building and home improvement trade |

Not realised |

*Kesko's own estimate |

|||