Frontpage ![]() Year 2010

Year 2010 ![]() Year 2010 in brief

Year 2010 in brief

Year 2010 in brief

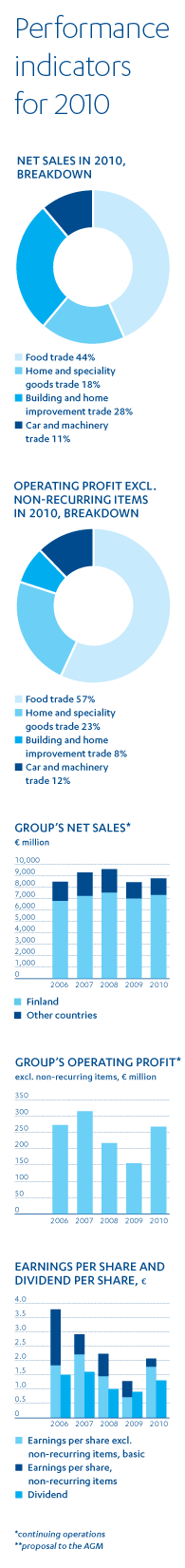

- The Kesko Group's net sales in January-December 2010 totalled €8,777 million (€8,447 million)

- Operating profit excluding non-recurring items was €268.1 million (€155.4 million)

- Profitability improved in all divisions

- Earnings per share excluding non-recurring items were €1.78 (€0.71)

- The Board of Directors proposes to the Annual General Meeting that €1.30 per share (€0.90) be distributed as a dividend for 2010

Net sales and sales increased

In 2010, Kesko's net sales were back on growth path, representing an increase of 3.9% from the previous year. Net sales increased in all divisions. In Finland, net sales increased by 4.3% and in other countries by 2.2%.

The K-Group's (Kesko's and chain stores') retail and B2B sales (VAT 0%) totalled €10,977 million and increased by 4.2% from the previous year.

In the food trade, net sales were €3,896 million, up 2.6% from the previous year. The grocery sales of K-food stores increased by 4.2% (VAT 0%). Good sales performance was achieved especially by K-citymarkets and K-supermarkets. The sales of Pirkka products increased by 11.2%. K-food stores' market share increased in 2010. The operating profit excluding non-recurring items of the food trade was €160.1 million, an increase of €27.0 million.

In the home and speciality goods trade, net sales were €1,569 million, up 0.7% from the previous year. K-citymarket's home and speciality goods, Intersport's and Budget Sport's sales developed best. The operating profit excluding non-recurring items of the home and speciality goods trade was €66.0 million, an increase of €36.5 million.

In the building and home improvement trade, net sales were €2,519 million, up 9.0%. The building and home improvement market in all operating countries turned up during the latter half of the year. The operating profit excluding non-recurring items of the building and home improvement trade was €24.0 million, an increase of €12.1 million.

In the car and machinery trade, net sales were €955 million, up 0.8%. The comparable net sales grew by 15.1%. The impact of the car tax change (effective 1 April 2009) and the discontinued Baltic grain and agricultural inputs trade have been eliminated from the comparable net sales. VV-Auto’s sales increased and the year-end volume of orders was higher than in the previous year. The combined market share of Audi, Volkswagen and Seat rose to 19%. Konekesko's comparable net sales increased by 6.2%. The operating profit excluding non-recurring items of the car and machinery trade was €33.1 million, an increase of €32.7 million.

Profitability improved in all divisions

Kesko's operating profit excluding non-recurring items was €268.1 million, up €112.8 million from the previous year. Operating profit excluding non-recurring items exceeded the level of the previous year in all divisions. Solvency and liquidity remained at an excellent level.

Store network is strengthened

In 2010, the Group's capital expenditure totalled €325.3 million (€198.0 million). Capital expenditure in store sites was €212.2 million.

The food trade segment invests strongly in the expansion and renovation of the store network. A new K-citymarket in Iisalmi and seven K-supermarkets and eight K-markets were opened in 2010. In addition, one K-supermarket was extended and turned into a K-citymarket, while renovations and extensions were made in several stores.

In the home and speciality goods trade, a new Kodin Ykkönen department store was opened in Lappeenranta.

The network of building and home improvement stores will be expanded in Finland and other operating countries, particularly in Russia, in the next few years. In 2010, one new K-rauta store was opened in Jyväskylä, Finland, one in Stockholm, Sweden, and two stores in nearby areas of Moscow, Russia.

Statutory pension liability is transferred to Ilmarinen

On 1 September 2010, the management of the statutory pension liability and the related insurance portfolio of some 3,100 people employed by the Kesko Group were transferred from the Kesko Pension Fund to Ilmarinen Mutual Pension Insurance Company. The insurance portfolio is transferred in two phases; the second phase will not be implemented until the beginning of 2012 at the earliest.

Number of foreign shareholders increased

The number of shareholders totalled 38,258 at the end of 2010, a decrease of 630 from the previous year. Foreign shareholders owned 38% of the B shares at the end of the year, compared with 30% the previous year.

Performance indicators for 2010

| Key figures | 2010 | 2009 | Change | ||

| Net sales | € million | 8,777 | 8,447 | 3.9 | % |

| Operating profit | € million | 306.7 | 232.3 | 74.4 | milj. € |

| Operating profit excl. non-recurring items |

€ million | 268.1 | 155.4 | 112.8 | milj. € |

| Profit before tax | € million | 312.4 | 216.6 | 95.8 | milj. € |

| Return on capital employed | % | 15.9 | 11.0 | 4.9 | %-yks. |

| Return on equity | % | 10.1 | 6.6 | 3.5 | %-yks. |

| Cash flow from operating activities |

€ million | 438 | 379 | 15.7 | % |

| Capital expenditure | € million | 325 | 198 | 64.3 | % |

| Equity ratio | % | 53.4 | 54.1 | -0.7 | %-yks. |

| Gearing | % | -16.8 | -12.5 | -4.3 | %-yks. |

| Dividend per share | € | 1.30* | 0.90 | 44.4 | % |

| Earnings per share, diluted | € | 2.06 | 1.27 | 62.1 | % |

| Equity per share, adjusted | € | 21.81 | 20.39 | 7.0 | % |

| Personnel, average | 18,215 | 19,200 | -5.1 | % | |

*proposal to the AGM |

|||||