Frontpage ![]() Further information

Further information ![]() Shares and shareholders

Shares and shareholders

Shares and shareholders

Dividend policy

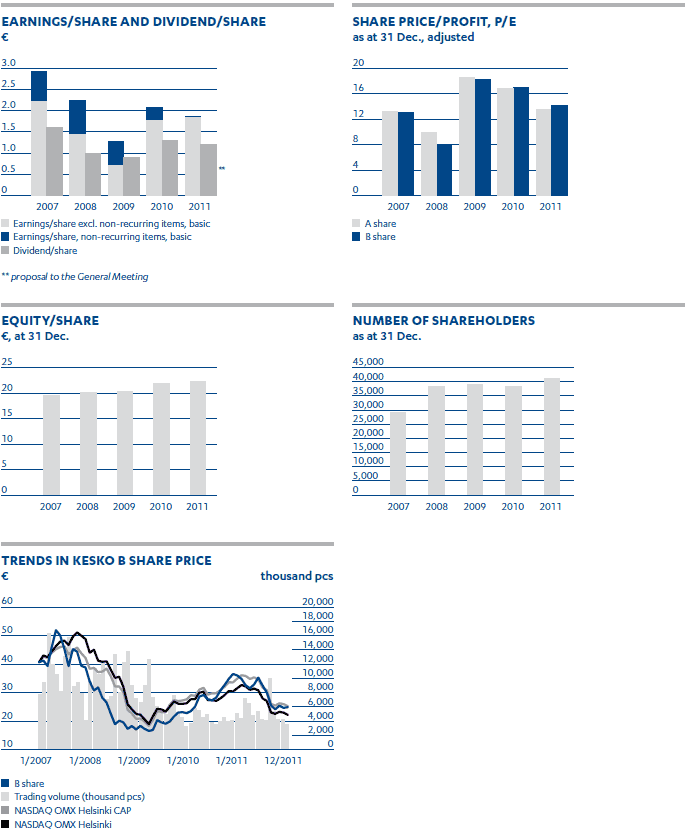

According to Kesko Corporation’s revised dividend policy, Kesko Corporation distributes at least 50% of its earnings per share excluding non-recurring items as dividends taking into account, however, the company’s financial position and operating strategy.

The financial objectives are presented on Strategic objectives.

Proposed dividends for the year 2011

Kesko Corporation’s Board of Directors proposes to the General Meeting that a dividend of €1.20 per share be distributed from the net profit for 2011, representing 65% of earnings per share and 65% of earnings per share excluding non-recurring items. In the past five years, 81.4% of earnings per share excluding non-recurring items, on average, has been distributed as dividends.

Basic information on the shares as at 31 december 2011

A share

- symbol: KESAV (OMX)

- ISIN code: FI0009007900

- voting rights per share: 10 votes

- number of shares: 31,737,007

- market capitalisation: €788 million

B share

- symbol: KESBV (OMX)

- ISIN code: FI0009000202

- voting rights per share: 1 vote

- number of shares: 66,908,035

- market capitalisation: €1,719 million

Trading unit of both share series: 1 share.

Total share capital: €197,282,584

Total number of shares: 98,645,042

Voting rights carried by all shares: 384,278,105.

Total market capitalisation: €2,506 million

Share series and share capital

Kesko Corporation’s share capital is divided into A and B share series. The company’s share capital was €197,282,584.

The minimum number of A shares is one (1) and the maximum number two hundred and fifty million (250,000,000), while the minimum number of B shares is one (1) and the maximum number two hundred and fifty million (250,000,000), provided however that the minimum aggregate number of shares is two (2) and the maximum aggregate number is four hundred million (400,000,000). The total number of shares is 98,645,042, of which 31,737,007 (32.2%) are A shares and 66,908,035 (67.8%) are B shares.

Each A share carries 10 votes and each B share one vote. Both shares have equal dividend rights. The number of votes carried by A shares is 83% and the number of votes carried by B shares is 17% of the total voting rights.

The shares are included in the book-entry securities register held by Euroclear Finland Ltd.

The right to receive funds distributed by the company and to subscribe for shares when shares are issued belongs only to those

- who are registered as shareholders in the shareholder register at the record date

- whose right to receive payments has been entered into the book-entry securities account of the shareholder registered in the shareholder register by the record date, and registered in the shareholder register

- and if a share is registered in a nominee name, into whose book-entry securities account the share is registered at the record date, and whose custodian is registered in the shareholder register as the custodian of the shares at the record date.

Authorisations of the board and treasury shares

2009 share issue authorisation

The Annual General Meeting held on 30 March 2009 authorised the company’s Board of Directors to decide on the issuance of a maximum of 20,000,000 new B shares. The new shares can be issued against payment either in a directed issue to the company’s existing shareholders in proportion to their existing shareholdings regardless of whether they consist of A or B shares; or in a directed issue deviating from the shareholders’ pre-emptive rights in order for the issued shares to be used as consideration in possible company acquisitions, other company business arrangements, or to finance capital expenditures. The company must have a weighty financial reason for deviating from the shareholders’ pre-emptive rights.

The Board’s authorisation also included the authority to decide about the subscription price of the shares, to issue shares against non-cash consideration, and to make decisions concerning any other matters relating to share issues. The share subscription price is recorded in the reserve of invested non-restricted equity.

The share issue authorisation will remain valid until 30 March 2012. The authorisation has not been used.

2011 share issue authorisation

The Annual General Meeting held on 4 April 2011 authorised the company’s Board of Directors to decide on the issuance of a maximum of 1,000,000 own B shares held by the company itself. Own B shares held by the company itself can be issued for subscription by shareholders in a directed issue in proportion to their existing holdings of the company shares, regardless of whether they own A or B shares. Shares can also be issued in a directed issue, deviating from the shareholder’s pre-emptive right, for a weighty financial reason of the company, such as using the shares to develop the company’s capital structure, to finance possible business acquisitions, capital expenditures or other arrangements within the scope of the company’s business operations, and to implement the company’s incentive plan.

Own B shares held by the company itself can be delivered either against or without consideration. According to the Finnish Limited Liability Companies’ Act, a directed share issue can only be without consideration, provided that the company, taking into account the best interests of all of its shareholders, has a particularly weighty financial reason. The authorisation also included the authority to make decisions concerning any other issues related to share issuances. The amount possibly paid for the company’s own shares is recorded in the reserve of unrestricted equity.

The authorisation will remain valid until 30 June 2014.

Authorisation to acquire own shares

The Annual General Meeting held on 4 April 2011 authorised the company’s Board of Directors to decide on the acquisition of a total maximum of 1,000,000 own B shares.

Own shares are acquired with the company’s unrestricted equity not in proportion to shares held by shareholders but at the market price quoted in public trading organised by NASDAQ OMX Helsinki Ltd (“stock exchange”) at the date of acquisition. The shares are acquired and paid in accordance with the rules of the stock exchange.

The shares can be acquired to be used in the development of the company’s capital structure, to finance possible business acquisitions, capital expenditures and/or other arrangements within the scope of the company’s business operations, and to implement the company’s incentive plan.

The Board makes decisions concerning other issues related to the acquisition of own B shares.

The authorisation will remain valid until 30 September 2012.

Kesko Corporation holds 700,000 own B shares. Subsidiaries do not hold Kesko Corporation shares.

Shareholders

According to the register of Kesko Corporation’s shareholders held by the Euroclear Finland Ltd, there were 41,215 shareholders at the end of 2011 (38,258 at the end of 2010). The total number of shares registered in a nominee name was 18,654,661, accounting for 18.91% of all shares (25,042,687 and 25.39% respectively at the end of 2010). These shares carried 19,305,001 votes, or 5.02% of the total voting rights (25,633,807 or 6.67% respectively at the end of 2010). A list of Kesko Corporation’s largest shareholders, updated monthly, is available at www.kesko.fi/investors.

2011–2013 share-based compensation plan

Kesko operates the 2011–2013 share-based compensation plan designed for the Group’s management personnel and other named key personnel, decided by the company’s Board of Directors. The plan allows a total maximum of 600,000 treasury B shares held by the company to be issued over the three-year period.

The share-based compensation plan includes three vesting periods, namely the calendar years 2011, 2012 and 2013. Kesko’s Board of Directors determines the target group and vesting criteria separately for each vesting period based on the Remuneration Committee’s proposal, and the compensation possibly paid after each vesting period is based on the fulfilment of the vesting criteria determined for the vesting period by the Board. The criteria for the 2011 vesting period are Kesko’s basic earnings per share (EPS) excluding non-recurring items, the 2011 performance of the Kesko Group’s sales exclusive of tax, and the percentage by which the total shareholder return (TSR) of a Kesko B share exceeds the OMX Helsinki Benchmark Cap index.

The compensation possibly paid for a vesting period is paid partly in Kesko B shares and partly in cash. The cash compensation is paid to cover the taxes and tax related charges payable on the compensation.

A commitment period of three calendar years following each vesting period is attached to the shares issued in compensation, during which shares must not be transferred. If a person’s employment or service relationship terminates prior to the end of the commitment period, he or she must return the shares subject to transfer restriction to Kesko or its designate without consideration.

So far, shares have not been issued under this plan.

2007 option scheme

On 26 March 2007, the Annual General Meeting decided to grant a total of 3,000,000 options for no consideration to the management of the Kesko Group, other key personnel, and a subsidiary wholly owned by Kesko Corporation. The Company had a weighty financial reason for granting the options because they are intended to be part of Kesko’s share-based incentive system.

Each option entitles its holder to subscribe for one new Kesko Corporation B share. The options were marked with symbols 2007A (KESBVEW107, ISIN code FI0009637201), 2007B (KESBVEW207, ISIN code FI0009637219) and 2007C (KESBVEW307, ISIN code FI0009637227) in units of 1,000,000 options each.

The exercise periods of options are:

- 2007A: 1 April 2010–30 April 2012,

- 2007B: 1 April 2011–30 April 2013 and

- 2007C: 1 April 2012–30 April 2014.

The original share subscription price for option 2007A was the trade volume weighted average quotation of a Kesko Corporation B share on the Helsinki Stock Exchange between 1 April and 30 April 2007 (EUR 45.82), for option 2007B, between 1 April and 30 April 2008 (EUR 26.57), and for option 2007C, between 1 April and 30 April 2009 (EUR 16.84). The subscription prices of shares subscribed for with stock options shall be reduced by the amount decided after the beginning of the period for the determination of the subscription price but before the subscription as at the record date for each dividend distribution or other distribution of funds. After the 2010 dividend distribution, the subscription price of a B share subscribed for with option 2007A is €41.02, with option 2007B €23.37 and with option 2007C €14.64. The share subscription price is recognised in the reserve of invested non-restricted equity.

If all of the exercisable share options were exercised, the shares subscribed for with all of the 2007 options would account for 2.95% of all shares and for 0.77% of all votes. The subscriptions made with share options can raise the number of the company’s shares to 101,641,292. As a result of the subscriptions, the voting rights carried by all shares could increase to 387,274,355 votes.

Share subscriptions with options

During 2011, the number of shares was increased twice corresponding to share subscriptions with the share options of the 2007 option plan. The increases were made on 31 May 2011 (2,750 B shares) and

1 August 2011 (1,000 B shares). The number of shares was raised by a total of 3,750 shares in 2011.

By the end of 2011, a total of 3,750 B shares have been subscribed for with 2007B options under the 2007 series option scheme. So far, 2007A share options have not been exercised. The exercise period of 2007C share options will begin on 1 April 2012.

The shares subscribed for in 2011 were included on the main list of NASDAQ OMAX Helsinki (the Helsinki stock exchange) for public trading.

Other special rights entitling to shares

The company has not issued other share options, convertible bonds, bonds with warrants or other special rights entitling to company shares.

Shares and options held by the management

At the end of 2011, the members of Kesko Corporation’s Board of Directors, the President and CEO and the corporations under their control held 229,720 Kesko Corporation A shares (224,720 at the end of 2010) and 109,420 Kesko Corporation B shares (105,820), or a total of 339,140 shares (330,540), which represents 0.34% (0.34%) of the company’s total share capital and 0.63% (0.61%) of the voting rights.

At the end of 2011, the company’s President and CEO held a total of 130,000 Kesko Corporation share options (150,000 at the end of 2010), which represents 0.13% (0.15%) of the company’s total share capital and 0.03% (0.04%) of voting rights, presuming that shares have been subscribed for with all of the options. The Board members did not hold options at the end of 2011 (nor at the end of 2010).

Detailed information on shares and options held by the management at the beginning and at the end of 2011 is given on Board of Directors and on Corporate Management Board.

Trading in kesko corporation’s shares and share options in 2011

Kesko Corporation’s shares are listed on the Helsinki stock exchange NASDAQ OMX Helsinki Ltd. Key information on share trading in 2011 is given in the graphs on the following double page spread. The price trends of both shares followed the general share price trend. The price of liquid B shares decreased by 26% and those of less liquid A shares by 28%, while the NASDAQ OMX Helsinki All Share Index decreased by 30%. The number and value of B shares traded on the Helsinki stock exchange rose by about one fifth. At the end of the year, the market capitalisation of A shares was €788million and that of B shares €1,719 million. The total market capitalisation of the company was €2,506 million, a decrease of €932 million, or 27% during the year.

Flagging notifications

Kesko Corporation did not receive any flagging notifications in 2011. The company is not aware of any agreements concerning its shareholding and voting rights.

Share performance indicators

READ MORE

More share performance indicators here.

Price and turnover of Kesko Corporation A and B share on the |

|||||||

| Share | Share price, €

at 31 Dec. 2010 |

Share price, € at 31 Dec. 2011 |

Change, % | Lowest price, € |

Highest price, € |

Trading volume, pcs |

Total value traded, € |

| A share | 34.70 | 24.82 | -28.5 | 22.35 | 36.00 | 2,098 | 61,671 |

| B share | 34.93 | 25.96 | -25.7 | 22.21 | 35.97 | 63,304 | 1,856,087 |

During the year, the NASDAQ OMX Helsinki All Share Index decreased by 30.1% and the NASDAQ OMX Helsinki CAP Index by 28.0% and the Helsinki Stock Exchange Consumer Staples Index by 24.3%. Up-to-date information on share and shareholders is available at www.kesko.fi/en.

10 largest shareholders by number of shares (A and B series) as at 31 Dec. 2011 |

|||||

| Number of shares, pcs |

% of shares | Number of votes | % of votes | ||

| 1 | Ilmarinen Mutual Pension Insurance Company | 3,573,257 | 3.62 | 6,182,915 | 1.61 |

| 2 | The K-Retailers´ Association | 3,514,958 | 3.56 | 34,781,930 | 9.05 |

| 3 | Vähittäiskaupan Takaus Oy | 3,491,771 | 3.54 | 27,148,568 | 7.06 |

| 4 | Kruunuvuoren Satama Oy | 2,635,046 | 2.67 | 26,350,460 | 6.86 |

| 5 | Valluga-sijoitus Oy | 1,340,439 | 1.36 | 13,404,390 | 3.49 |

| 6 | Kesko Pension Fund | 1,288,839 | 1.31 | 8,523,390 | 2.22 |

| 7 | Varma Mutual Pension Insurance Company | 1,130,986 | 1.15 | 1,130,986 | 0.29 |

| 8 | Tapiola Mutual Pension Insurance Company | 1,100,000 | 1.12 | 1,100,000 | 0.29 |

| 9 | Oy The English Tearoom Ab | 1,008,400 | 1.02 | 1,008,400 | 0.26 |

| 10 | Foundation for Vocational Training in the Retail Trade | 975,547 | 0.99 | 8,384,518 | 2.18 |

Ownership structure as at 31 Dec. 2011 |

|||

| All shares | Number of shares | % of all shares | |

| Non-financial corporations and housing corporations | 28,785,760 | 29.18 | |

| Financial and insurance corporations | 5,238,693 | 5.31 | |

| General Government* | 10,085,573 | 10.22 | |

| Households | 28,439,926 | 28.83 | |

| Non-profit institutions serving households** | 6,478,763 | 6.57 | |

| Rest of the world | 961,666 | 0.97 | |

| Nominee registered | 18,654,661 | 18.91 | |

| Total | 98,645,042 | 100.00 | |

| A shares | Number of shares | % of A shares | % of all shares |

| Non-financial corporations and housing corporations | 20,574,728 | 64.83 | 20.86 |

| Financial and insurance corporations | 1,433,430 | 4.52 | 1.45 |

| General Government* | 1,204,419 | 3.79 | 1.22 |

| Households | 6,750,236 | 21.27 | 6.84 |

| Non-profit institutions serving households** | 1,694,523 | 5.34 | 1.72 |

| Rest of the world | 7,411 | 0.02 | 0.01 |

| Nominee registered | 72,260 | 0.23 | 0.07 |

| Total | 31,737,007 | 100.00 | 31.74 |

| B shares | Number of shares | % of B shares | % of all shares |

| Non-financial corporations and housing corporations | 8,211,032 | 12.27 | 8.32 |

| Financial and insurance corporations | 3,805,263 | 5.69 | 3.86 |

| General Government* | 8,881,154 | 13.27 | 9.00 |

| Households | 21,689,690 | 32.42 | 21.99 |

| Non-profit institutions serving households** | 4,784,240 | 7.15 | 4.85 |

| Rest of the world | 954,255 | 1.43 | 0.97 |

| Nominee registered | 18,582,401 | 27.77 | 18.84 |

| Total | 66,908,035 | 100.00 | 67.83 |

| * General government, for example, municipalities, the provincial administration of Åland, authorised pension provider and social security funds. |

|||

| ** Non-profit institutions, for example, foundations awarding scholarships, organisations safeguarding certain interests and various charitable associations. |

|||

10 largest shareholders by number of votes at 31 Dec. 2011 |

|||||

| Number of shares, pcs |

% of shares | Number of votes |

% of votes | ||

| 1 | The K-Retailers´ Association | 3,514,958 | 3.56 | 34,781,930 | 9.05 |

| 2 | Vähittäiskaupan Takaus Oy | 3,491,771 | 3.54 | 27,148,568 | 7.06 |

| 3 | Kruunuvuoren Satama Oy | 2,635,046 | 2.67 | 26,350,460 | 6.86 |

| 4 | Valluga-sijoitus Oy | 1,340,439 | 1.36 | 13,404,390 | 3.49 |

| 5 | Kesko Pension Fund | 1,288,839 | 1.31 | 8,523,390 | 2.22 |

| 6 | Foundation for Vocational Training in the Retail Trade | 975,547 | 0.99 | 8,384,518 | 2.18 |

| 7 | Ilmarinen Mutual Pension Insurance Company | 3,573,257 | 3.62 | 6,182,915 | 1.61 |

| 8 | Food Paradise Oy | 389,541 | 0.39 | 3,895,410 | 1.01 |

| 9 | The K-Food Retailers´ Club | 384,617 | 0.39 | 3,846,170 | 1.00 |

| 10 | Heimo Välinen Oy | 362,000 | 0.37 | 3,431,000 | 0.89 |

Distribution of share ownership at 31 Dec. 2011 |

||||

| All shares

Number of shares |

Number of shareholders |

% of shareholders |

Shares total |

% of shares |

| 1–100 | 12,319 | 29.89 | 703,127 | 0.71 |

| 101–500 | 15,691 | 38.07 | 4,273,662 | 4.33 |

| 501–1,000 | 5,675 | 13.77 | 4,456,910 | 4.52 |

| 1,001–5,000 | 5,814 | 14.11 | 12,849,184 | 13.03 |

| 5,001–10,000 | 910 | 2.21 | 6,503,551 | 6.59 |

| 10,001–50,000 | 660 | 1.60 | 13,503,073 | 13.69 |

| 50,001–100,000 | 80 | 0.19 | 5,780,765 | 5.86 |

| 100,001–500,000 | 50 | 0.12 | 10,685,107 | 10.83 |

| 500,001–999,999,999,999 | 16 | 0.04 | 39,889,663 | 40.44 |

| Total | 41,215 | 100.00 | 98,645,042 | 100.00 |

| A shares

Number of shares |

Number of shareholders |

% of holders of A shares |

A shares total | % of A shares |

| 1–100 | 2,169 | 30.11 | 104,680 | 0.33 |

| 101–500 | 1,622 | 22.52 | 419,964 | 1.32 |

| 501–1,000 | 1,049 | 14.56 | 900,509 | 2.84 |

| 1,001–5,000 | 1,604 | 22.27 | 3,928,052 | 12.38 |

| 5,001–10,000 | 386 | 5.36 | 2,741,092 | 8.64 |

| 10,001–50,000 | 322 | 4.47 | 6,883,026 | 21.69 |

| 50,001–100,000 | 33 | 0.46 | 2,370,201 | 7.47 |

| 100,001–500,000 | 13 | 0.18 | 2,684,299 | 8.46 |

| 500,001–999,999,999,999 | 6 | 0.08 | 11,705,184 | 36.88 |

| Total | 7,204 | 100.00 | 31,737,007 | 100.00 |

B shares Number of shares |

Number of shareholders |

% of holders of B shares |

B shares total | % of B shares |

| 1–100 | 11,091 | 30.41 | 647,475 | 0.97 |

| 101–500 | 14,933 | 40.94 | 4,080,459 | 6.10 |

| 501–1,000 | 4,905 | 13.45 | 3,791,808 | 5.67 |

| 1,001–5,000 | 4,577 | 12.55 | 9,741,907 | 14.56 |

| 5,001–10,000 | 535 | 1.47 | 3,885,864 | 5.81 |

| 10,001–50,000 | 351 | 0.96 | 6,988,437 | 10.44 |

| 50,001–100,000 | 39 | 0.11 | 2,866,307 | 4.28 |

| 100,001–500,000 | 34 | 0.09 | 7,755,704 | 11.59 |

| 500,001–999,999,999,999 | 11 | 0.03 | 27,150,074 | 40.58 |

| Total | 36,476 | 100.00 | 66,908,035 | 100.00 |