Etusivu ![]() Corporate Governance

Corporate Governance ![]() Corporate Governance

Corporate Governance

Kesko's Corporate Governance

Rules and corporate governance code observed by Kesko

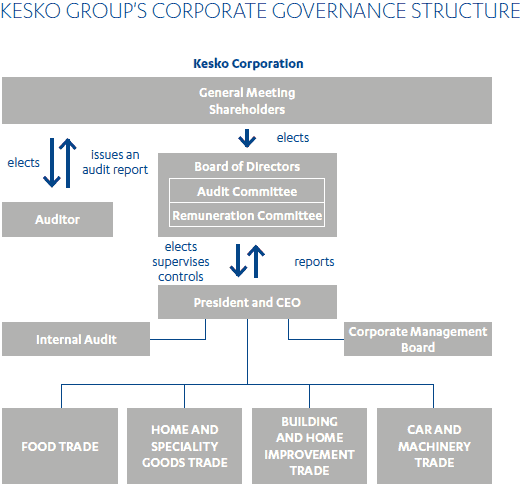

Kesko Corporation (Kesko or the company) is a Finnish public limited company in which the duties and responsibilities of its executive bodies are defined according to Finnish laws. The Kesko Group is composed of the parent company, Kesko, and its subsidiaries.

Kesko's decision-making and corporate governance are guided by Kesko's values and responsible operating practices. Decision-making and corporate governance comply with the Finnish Limited Liability Companies Act, regulations concerning publicly quoted companies, Kesko's Articles of Association, the charters of Kesko's Board of Directors and its Committees and the rules and guidelines of NASDAQ OMX Helsinki Ltd. The company complies with the Finnish Corporate Governance Code for Listed Companies 2010 (available at www.cgfinland.fi).

As provided by the Comply or Explain principle of the Corporate Governance Code, the company departs from the Corporate Governance Code's recommendation concerning a Board member's terms of office. According to Kesko's Articles of Association, the term of a Board member is three years, whereas recommendation 10 of the Corporate Governance Code recommends that Board members should be elected for a term of one year. A shareholder who, together with related entities, holds over 10% of all votes carried by the Kesko shares, has informed the company's Board that it considers the term of three years good for the company's long-term development and sees no need to shorten the term of office stated in the Articles of Association.

General Meeting

The highest decision-making power in Kesko is exercised by the company's shareholders at the company's General Meeting. The company's shareholders elect the company's Board and auditor at the Annual General Meeting (AGM). The company uses a so-called one-tier governance model.

The AGM, which is held by the end of June on a date designated by the company's Board, handles the business specified for the AGM in the Articles of Association and any other proposals that may be made to the General Meeting. If needed, the company may also hold Extraordinary General Meetings.

General Meetings are convened by the company's Board. A shareholder has the right, by virtue of the Limited Liability Companies Act, to put matters that fall within the competence of the General Meeting on the agenda of the AGM. A shareholder shall make a possible request in time for the matter to be included in the agenda of a General Meeting not later than the date given on the company's website www.kesko.fi/en/ and following the instructions. As a rule, a General Meeting handles the business proposed to it by the company's Board.

Major matters within the competence of the General Meeting

The most significant matters falling within the competence of the General Meeting include: resolution on the number of Board members and the election of Board members, resolutions on the remuneration and financial benefits of the Board members and members of the Board's Committees, election of the auditor and resolution on the auditor's fee, adoption of the financial statements, resolution on discharging the Board members and the Managing Director from liability, amending the Articles of Association, resolutions on share issuances and on the distribution of the company's assets, such as profit distribution.

When votes are taken, a proposal for which more than half of the votes were given will normally be a resolution of the General Meeting, as prescribed by the Limited Liability Companies Act. However, the Act specifies several matters where a resolution requires an enhanced qualified majority prescribed by law.

Convening the general meeting

Shareholders are invited to the General Meeting by a notice published in at least two nationwide newspapers. The notice of the meeting is delivered no earlier than two months and no later than three weeks before the General Meeting, but at least nine days before the record date of the General Meeting, referred to in the Finnish Limited Liability Companies Act. The notice of the meeting and the proposals of the company's Board to the General Meeting are published in stock exchange releases. The proposals for the number of Board members, for Board members and for Board members' remuneration made by shareholders holding at least 10% of the votes carried by the company shares are also published in a stock exchange release. The documents are also made available at www.kesko.fi/en.

Right to participate in the general meeting

All Kesko shareholders have the right to participate in Kesko's General Meetings by following the instructions given in the notice of each General Meeting. Shareholders may participate in the meeting themselves, or through proxy representatives. A shareholder or a proxy representative can have one assistant at the General Meeting

Minutes of the General Meeting

The minutes of the General Meeting are recorded and made available to shareholders at www.kesko.fi/en, together with appendices describing the resolutions of the meeting within two weeks from the General Meeting. The resolutions of the General Meeting are also published in a stock exchange release immediately after the meeting.

Presence of governing bodies at the general meeting

The company aims for all of Kesko's Board members, the President and CEO, and the auditor to be present at the AGM. An Extraordinary General Meeting is attended by the company's Board Chair, a sufficient number of members of the Board and its committees, and the President and CEO. A first-time candidate for the Board is present at the General Meeting deciding on his/her election, unless there is a weighty reason for his/her absence.

Share series

The company has share series A and B, which differ only with respect to the votes they carry. Each A share carries the right to ten votes and each B share to one vote at the General Meeting.

Board of Directors and its committees

Term, composition and independence of the Board

According to the Articles of Association, the term of office of a Board member is three years, starting at the close of the General Meeting electing the member and expiring at the close of the third AGM after the election.

According to the Articles of Association, Kesko's Board of Directors consists of a minimum of five and a maximum of eight members. The Board elects the Chair and the Deputy Chair from among its members for the whole term of the Board.

The Board of Directors elected by Kesko's AGM of 30 March 2009 consists of seven members:

- Heikki Takamäki (Chair)

- Seppo Paatelainen (Deputy Chair)

- Maarit Näkyvä

- Ilpo Kokkila

- Esa Kiiskinen

- Mikko Kosonen

- Rauno Törrönen.

In accordance with the Articles of Association, their terms will expire at the close of the 2012 AGM.

All of Kesko's Board members are non-executive directors.

The Board of Directors evaluates the independence of its members annually on a regular basis. Based on the latest evaluation carried out on 4 April 2011, the Board considers that all of its members are independent of the company's significant shareholders, and that the majority of the members is also independent of the company. Board members Takamäki, Kiiskinen and Törrönen are not independent of the company, because companies controlled by them have chain agreements with a Kesko Group company.

Main duties

Kesko's Board of Directors ensures that the company's administration, operations and accounting, as well as financial management controls are in place. The Board has confirmed the written charter for its duties, matters to be considered, meeting practice and the decision-making process. The Board considers and makes decisions on all matters that are financially, commercially or fundamentally significant for the Group.

The Board's main duties include:

- making decisions on the Group's strategy and confirming strategies for the divisions

- confirming the Group's rolling plan, which includes the capital expenditure plan

- approving the Group's financial and investment policy

- confirming the Group's risk management policy and considering the Group's most significant risks and uncertainties

- reviewing and adopting the consolidated financial statements, interim reports and related stock exchange releases and the report by the Board of Directors

- making decisions on strategically or financially important individual capital expenditures, acquisitions, disposals or other arrangements, and commitments

- making decisions on the essential Group composition and organisation

- appointing and dismissing the company's President and CEO, approving his/her managing director's service contract and making decisions on his/her compensation and other financial benefits

- making decisions on the principles of Kesko's remuneration plans and monitoring the implementation of the plans

- making possible proposals to the General Meeting for share and share-based remuneration plans, and making decisions on granting shares or share options under share and share-based re-muneration schemes, and on the terms and conditions for granting them

- establishing a dividend policy and being responsible for shareholder value performance

- confirming the company's values

- reviewing the Corporate Responsibility Report.

Decision-making, operations and meetings

The duty of Kesko's Board is to promote the best interests of Kesko and all of its shareholders. The Board members do not represent the interests of the parties who have proposed their election as Board members. A Board member is disqualified from participating in the handling of any matter between him/her and the company. When a vote is taken, the Board's decision will be the opinion of the majority. If a vote results in a tie, the decision will be the opinion supported by the Chair. If the votes cast at an election of a person end in a tie, the results will be decided by drawing lots.

In 2011, the Board held 10 meetings. The Board members' attendance rate at the Board meetings was 94.3%.

In its strategy work in 2011, the Board discussed the expansion of especially the food trade and other operations into Russia, and continued to discuss electronic customer communications and e-commerce. The Board approved and reformed the Kesko Group management's incentive plans by introducing a new share-based compensation plan. It also approved the Group's updated risk management policy. As in previous years, the Board reviewed the financial reports and monitored the Group's funding situation, approved the most significant capital expenditures, monitored the progress of Group-level projects and approved interim reports and the financial statements prior to their disclosure.

The Board meetings regularly include a review by the President and CEO on topical and important issues, as well as reports by the Chairs of the Board's Audit Committee and Remuneration Committee on preparatory committee meetings preceding Board meetings. The auditor presents his/her findings to the Board once a year in connection with the financial statements.

The Board regularly assesses its operations and working practices and carries out a related self-assessment once a year. Most recently, the Board made a self-assessment of its operations and working practices in December 2011. In the assessment, the Board noted that, for example, the two annual strategy meetings had enhanced the handling of the most significant matters for Kesko.

Board Committees

Kesko has a Board's Audit Committee and a Remuneration Committee, both of which consist of three Board members. At the close of the AGM, the Board elects the Chairs and the members of the Committees from among its members for one year at a time.

The Board of Directors has confirmed written charters for the Committees that lay down their main duties and operating principles.

The Committees have no independent decision-making power. Instead, the Board makes decisions based on the preparatory work of the Committees.

The Committees regularly assess their operations and working practices and carry out a related self-assessment once a year.

Audit Committee and its operations

The Audit Committee members are Maarit Näkyvä (Ch.), Seppo Paatelainen (Deputy Ch.) and Mikko Kosonen. All members of the Audit Committee are independent of the company and its significant shareholders. In the election of the Audit Committee members, the relevant qualification requirements have been taken into account.

According to its charter, the duties of the Audit Committee are:

- monitoring the Kesko Group's financial and funding situation and the process of the company's financial statements reporting

- supervising the company's financial reporting process

- evaluating the efficiency of the company's internal control, internal audit and risk management systems

- reviewing the Corporate Governance Statement submitted by the company

- approving the operating instructions, annual audit plan, budget and resources of the company's Internal Audit and handling the reports submitted to the Committee

- monitoring the statutory audit of the financial statements and the consoli-dated financial statements

- evaluating the independence of the company's audit firm

- preparing the draft resolution con-cerning the election of the company's auditor and keeping in contact with the company's auditor.

In 2011, the Audit Committee held five meetings, and its members' attendance rate at the Committee meetings was 93.3%. At the Committee meetings, the Group's CFO, the Corporate Controller, the Chief Audit Executive and the General Counsel regularly report on their areas of responsibility to the Committee. The Committee also receives reports on the Kesko Group's funding situation, risk management and insurances. The auditor is present at the Committee meetings and presents his/her audit plan and report to the Audit Committee.

During the year, the Committee reviewed reports on the Group's financial situation, including the financial statements release and interim reports and made a recommendation to the Board on handling the interim reports and the financial statements release. In addition, the Committee reviewed the Group's external and internal audit and risk management reports, the external quality evaluation report on the Group's internal audit and approved internal audit's operating instructions and audit plan, budget and resources for 2012. The Committee also evaluated the auditor's independence and consultation services to the Group. The Audit Committee has prepared and submitted a proposal to the AGM on the auditor to be elected for Kesko.

Attendance at meetings by members of the board and its committees in 2011 |

|||||

| Board member since |

Attendance | ||||

| Committee | Board | Audit Committee |

Remuneration Committee |

||

| Heikki Takamäki (Ch.) | 2001 | Remuneration Committee (Ch.) | 10/10 | - | 3/3 |

| Seppo Paatelainen (Dep. Ch.) | 2006 | Audit Committee (Dep. Ch.) Remuneration Committee (Dep. Ch.) |

10/10 | 5/5 | 3/3 |

| Esa Kiiskinen | 2009 | 10/10 | - | - | |

| Ilpo Kokkila | 2006 | Remuneration Committee | 9/10 | - | 3/3 |

| Mikko Kosonen | 2009 | Audit Committee | 10/10 | 5/5 | - |

| Maarit Näkyvä | 2001 | Audit Committee (Ch.) | 7/10 | 4/5 | - |

| Rauno Törrönen | 2009 | 10/10 | - | - | |

| BOARD MEMBERS' INDEPENDENCE IN 2011* | Independent of the company |

Independent of a significant shareholder |

|||

| Heikki Takamäki (Ch.) | No** | Yes | |||

| Seppo Paatelainen (Dep Ch.) | Yes | Yes | |||

| Esa Kiiskinen | No** | Yes | |||

| Ilpo Kokkila | Yes | Yes | |||

| Mikko Kosonen | Yes | Yes | |||

| Maarit Näkyvä | Yes | Yes | |||

| Rauno Törrönen | No** | Yes | |||

* Based on the independence evaluation carried out on 4 April 2011. ** Each of the companies controlled by Kiiskinen, Takamäki and Törrönen has a chain agreement with a Kesko Group company. |

|||||

Remuneration Committee and its operations

The Remuneration Committee members are Heikki Takamäki (Ch.), Seppo Paatelainen (Deputy Ch.) and Ilpo Kokkila. All members of the Audit Committee are independent of the company's significant shareholders and the majority is also independent of the company.

According to its charter, the duties of the Remuneration Committee are:

- preparing matters pertaining to the compensation and other financial benefits of the company's President and CEO, and preparing the managing director's service contract to the Board

- preparing matters pertaining to the compensation and other financial benefits of the Corporate Management Board members responsible for lines of business

- preparing matters pertaining to the appointment of the President and CEO and the Corporate Management Board members responsible for lines of business, and identification of their possible successors

- developing and preparing remuneration plans to the company's Board

- handling the remuneration statement.

In 2011, the Remuneration Committee held three meetings. Its members' attendance rate at the meetings was 100%. The Committee prepared proposals to the Board for a new long-term incentive plan targeted to the Group's management and key personnel, and for the principles of the management's performance bonus scheme.

More information on Kesko's Board members is available here and at www.kesko.fi/en.

Company management

President and CEO

Kesko has a managing director who is the President and CEO. Kesko's President and CEO is Matti Halmesmäki, Master of Science in Economics and Master of Laws. He has been Kesko's President and CEO since

1 March 2005.

The President and CEO's duty is to manage the company in accordance with the instructions and orders issued by the company Board and to inform the Board about the developments in the company's business operations and financial situation. He/she is also responsible for the company's day-to-day management and ensuring that financial matters are handled in a reliable manner. The President and CEO also chairs the Corporate Management Board and the Boards of the Group's major subsidiaries, Kesko Food Ltd, Rautakesko Ltd, VV-Auto Group Oy, and the Board of the home and speciality goods division.

The President and CEO is elected by the Board, which also makes the decisions on the terms of the President and CEO's service contract. A written managing director's service contract, approved by the Board, has been made between the company and the President and CEO.

More information on Kesko's President and CEO is available here and at www.kesko.fi/en.

Corporate Management Board

The Kesko Group has a Corporate Manage-ment Board, the Chair of which is Kesko's President and CEO. The Corporate Management Board has no authority based on legislation or the Articles of Association. The Corporate Management Board's duties are to discuss Group-wide development projects and Group-level policies and practices. In addition, the Corporate Management Board discusses the Group's and the division parent companies' business plans, profit performances and matters handled by Kesko's Board, in the preparation of which it also participates. The Corporate Management Board meets 8–10 times a year.

More information on Kesko's Corporate Management Board is available here and at www.kesko.fi/en.

Remuneration

Remuneration of the Board and its Committees

The AGM adopts resolutions on the fees and other financial benefits of the members of the Board and its Committees annually. The remunerations of the members of the Board and its Committees are paid in cash only.

Remuneration of the President and CEO and other management

The remuneration plan for the President and CEO and the other members of the Corporate Management Board consists of a non-variable monetary salary (monthly salary), fringe benefits (free car and mobile phone benefit), a performance bonus based on criteria set annually (the maximum performance bonus of President and CEO corresponds to his monetary salary for a maximum of eight months, and that of the other members of the Corporate Management, for a maximum of 4–5 months), share-based payment and share option plans and management's retirement benefits.

Based on the Remuneration Committee's preparatory work, Kesko's Board makes decisions on the individual compensation, other financial benefits, the performance bonus system criteria and the performance bonuses paid to the President and CEO and the Corporate Management Board members responsible for lines of business. The President and CEO makes decisions on the compensation and other financial benefits of the other Corporate Management Board members within the limits set by the Chair of the Board's Remuneration Committee.

More information on the Kesko management's remuneration and the company's share-based compensation and share option plans is available on Corporate Governance and on Corporate Management Board and at www.kesko.fi/en.

Corporate management board members and |

Since | Responsibility area |

| Matti Halmesmäki, Ch. | 1 Jan. 2001 | Kesko's President and CEO |

| Terho Kalliokoski, President of Kesko Food Ltd | 17 Mar. 2005 | Food trade |

| Minna Kurunsaari, Senior Vice President, home and speciality goods trade |

1 Dec. 2011 | Home and speciality goods trade, electronic marketing and services projects |

| Arja Talma, President of Rautakesko Ltd* | 17 Mar. 2005 | Building and home improvement trade |

| Pekka Lahti, President of VV-Auto Group Oy | 1 Mar. 2005 | Car and machinery trade |

| Riitta Laitasalo, Senior Vice President, Human Resources of Kesko |

1 Jan. 2001 | Human resources, K-instituutti |

| Merja Haverinen, Senior Vice President, Corporate Communications of Kesko |

1 Apr. 2011 | Corporate communications, responsibility, brands |

| Jukka Erlund, Senior Vice President, CFO of Kesko |

1 Nov. 2011 | Finance and accounting, IT management, financial services |

* Until 1 Nov. 2011, Talma was Senior Vice President, CFO of Kesko In 2011, the Corporate Management Board members also included Paavo Moilanen, Senior Vice President for Kesko's Corporate Communications until 31 Mar., Rautakesko Ltd's President Jari Lind until 9 Jun. and Matti Leminen, Senior Vice President, home and speciality goods trade, until 30 Nov. |

||

Annual and meeting fees paid to board members for |

|||||

| Meeting fees | |||||

| Annual fees | Board | Audit Committee | Remuneration Committee |

Total | |

| Heikki Takamäki (Ch.) | 80,000 | 5,000 | - | 1,500 | 86,500 |

| Seppo Paatelainen (Dep. Ch.) | 50,000 | 5,000 | 2,500 | 1,500 | 59,000 |

| Esa Kiiskinen | 37,000 | 5,000 | - | - | 42,000 |

| Ilpo Kokkila | 37,000 | 4,500 | - | 1,500 | 43,000 |

| Mikko Kosonen | 37,000 | 5,000 | 2,500 | - | 44,500 |

| Maarit Näkyvä | 37,000 | 3,500 | 4,000 | - | 44,500 |

| Rauno Törrönen | 37,000 | 5,000 | - | - | 42,000 |

| Total | 315,000 | 33,000 | 9,000 | 4,500 | 361,500 |

Board's annual and meeting fees resolved |

||

| Fee/year | ||

| Annual fee | 2009–2011 | 2006–2008 |

| Board Chair | 80,000 | 60,000* |

| Board Deputy Chair | 50,000 | 42,000* |

| Board member | 37,000 | 30,000* |

| * Monthly fees resolved in 2006–2008 converted into annual fees. | ||

| Fee/meeting | ||

| Meeting fee | 2009–2011 | 2006–2008 |

| Fee for a Board meeting | 500 | 500 |

| Fee for a Committee meeting | 500 | 500 |

| Committee Chair's fee for a Committee meeting, if he/she is not also the Board Chair or Deputy Chair | 1,000 | 1,000 |

President and ceo Matti Halmesmäki |

|||

Salaries, performance bonuses and fringe benefits in 2009–2011 (€) |

|||

| 2011 | 2010 | 2009 | |

| Non-variable monetary salary | 642,900 | 605,100 | 569,300 |

| Performance bonuses* | 339,500 | 227,500 | 152,250 |

| Fringe benefits | 19,980 | 22,560 | 23,014 |

| Total | 1,002,380 | 855,160 | 744,564 |

| * Paid based on previous year's performance. | |||

Share options granted 2007–2011 (pcs) |

||||

| Option (symbol) | 2010–2011 | 2009 | 2008 | 2007 |

| 2007A | - | 50,000 | ||

| 2007B | - | 50,000 | ||

| 2007C | - | 50,000 | ||

| Total | - | 50,000 | 50,000 | 50,000 |

At 31 Dec. 2011, the President and CEO held 50,000 2007A options, 30,000 2007B options and 50,000 2007C options. |

||||

Share-based payments (pcs) |

2011 | 2012 | |

| Maximum | 18,000 | 21,000* | |

| Granted* | 7,794 | ||

| Commitment period (until) | 31.12.2014 | 31.12.2015 | |

| * The Board's decision in February 2012. The share award for the 2011 vesting period will be paid by the end of April 2012 in accordance with the terms of the plan. The amount of the award for the 2012 vesting period will be decided in 2013. |

|||

Commitment period |

| The share award of Kesko B shares involves a commitment period of three years, following each vesting period, during which the shares may not be transferred. |

Retirement benefits |

| The President and CEO is a member of the Kesko Pension Fund's department A and his retirement benefits are determined based on the department's rules and his managing director's service contract. In 2011, his term of office, based on his managing director’s service contract, was extended until his retirement on old age pension at the age of 63. His retirement benefit is based on a defined benefit plan. At retirement, his pension will be 66% of his pensionable salary, which is determined based on his non-variable monetary salary, performance bonuses and fringe benefits for the last 10 years. |

Period of notice and termination benefit |

|||

| If the President and CEO's service contract is terminated by the company, he is paid a 12-months' salary and a separate lump sum termination benefit, which corresponds to his 12-months' salary and fringe benefits (a total of 24 x termination month's salary + fringe benefits). If the President and CEO resigns, he is entitled to a 6-months' salary for the notice period. |

|||

Commitment period* |

Ownership obligation |

||

| 4/2007–4/2010 | 25% of proceeds from share option sales shall be used to purchase company shares for permanent ownership. |

||

| 4/2008–4/2011 | |||

| 4/2009–4/2012 | |||

| * During which share options may not be assigned or exercised . | |||

The share award is based on the fulfilment of the vesting criteria set by the Board for each vesting period. The Board annually decides on the vesting criteria and the maximum share awards at the beginning of the vesting period. At the beginning of the year following the vesting period, the Board decides the final amounts of Kesko B shares to be granted based on the fulfilment of the vesting criteria. The criteria for the 2011–2013 vesting periods with equal weightings are Kesko's basic earnings per share (EPS) excl. non-recurring items, the performance of the Kesko Group's sales exclusive of tax during the vesting period, and the percentage by which the total shareholder return of a Kesko B share exceeds the OMX Helsinki Benchmark Cap index. In addition, a cash component is paid to cover the taxes and tax-like charges incurred by the award. |

|||

Salaries, performance bonuses and fringe benefits of corporate management |

||||||||

| Non-variable monetary salary | Performance bonuses | Fringe benefits | Total | |||||

| 2011 | 2010 | 2011 | 2010 | 2011 | 2010 | 2011 | 2010 | |

| Matti Halmesmäki (Ch.) | 642,900 | 605,100 | 339,500 | 227,500 | 19,980 | 22,560 | 1,002,380 | 855,160 |

| Corporate Management Board** | 1,537,924 | 1,515,860 | 438,500 | 244,250 | 97,127 | 112,080 | 2,073,550 | 1,872,190 |

| Total | 2,180,824 | 2,120,960 | 778,000 | 471,750 | 117,107 | 134,640 | 3,075,930 | 2,727,350 |

* Salaries, performance bonuses and fringe benefits are reported on cash basis. The 2010 accrual is calculated by adding the amount of performance bonus paid in 2011 to the salaries and fringe benefits in 2010. The performance bonus accrued for 2011 will be decided in spring 2012. ** Excluding President and CEO Halmesmäki. The amounts reported for the Corporate Management Board reflect the changes in its composition in 2011 and they include each member's salaries, performance bonuses and fringe benefits for their terms of office. |

||||||||

Share options granted to corporate management |

|||||

| Grant year | 2010–2011 | 2009 | 2008 | 2007 | |

| Share option (symbol) | (2007C) | (2007B) | (2007A) | ||

| Matti Halmesmäki, Ch. | - | 50,000 | 50,000 | 50,000 | |

| Corporate Management Board* | - | 115,000 | 100,000 | 99,500 | |

| Total | - | 165,000 | 150,000 | 149,500 | |

| * Excluding President and CEO Halmesmäki. The amounts reported for the Corporate Management Board reflect the changes in its composition in 2011 and include the share option amounts of Kurunsaari, Erlund and Haverinen as they joined the Corporate Management Board in 2011. |

|||||

At 31 Dec. 2011, Corporate Management Board member, President and CEO Halmesmäki held 50,000 2007A, 30,000 2007B and 50,000 2007C share options and the other Corporate Management Board members held a total of 95,000 2007A, 84,750 2007B and 115,000 2007C share options, or all Corporate Management Board members held a total of 145,000 2007A, 114,750 2007B and 165,000 2007C share options. |

|||||

| The share options 2007A-2007C include an obligation set by Kesko's Board to option recipients to use 25% of the proceeds from their share options to buy company shares for permanent ownership. The vesting periods (during which share options cannot be assigned or exercised) are as follows: 2007A: 4/2007–4/2010; 2007B: 4/2008–4/2011; 2007C: 4/2009–4/2012. |

|||||

Share-based payments to corporate management board members (pcs) |

||||

| 2011 | 2012 | |||

| Maximum | To be granted** |

Maximum** | ||

| Matti Halmesmäki, Ch. | 18,000 | 7,794 | 21,000 | |

| Corporate Management Board* | 33,300 | 14,419 | 40,500 | |

| Total | 51,300 | 22,213 | 61,500 | |

Each vesting period attached to the Kesko B share awards is followed by a commitment period of three calendar years, during |

||||

Retirement benefits, notice periods and |

||||||

| Retirement pension age (yrs) |

Pension as percentage of pensionable salary (%) |

Period of notice |

Termination benefit |

|||

| Matti Halmesmäki, Ch. | 63 | 66 | 6*/12 mo | 12 mo salary | If the company terminates the executive's service contract, he/she is paid a 6–12 months' salary for the period of notice and a separate lump sum termination benefit representing his/her 6–12 months' non-variable monetary salary and fringe benefits (a total of 12–24 x salary for the month of termination + fringe benefits). If the executive resigns, he/she is entitled to a salary for the period of notice. |

|

| Terho Kalliokoski | 62 | 66 | 6 mo | 6 mo salary | ||

| Minna Kurunsaari | 62 | 66 | 6 mo | 6 mo salary | ||

| Arja Talma | based onTyEL** | based onTyEL** | 6 mo | 6 mo salary | ||

| Pekka Lahti | 62 | 66 | 6 mo | 12 mo salary | ||

| Riitta Laitasalo | 60 | 66 | 6 mo | 12 mo salary | ||

| Merja Haverinen | based onTyEL** | based onTyEL** | 6 mo | 6 mo salary | ||

| Jukka Erlund | based onTyEL** | based onTyEL** | 6 mo | 6 mo salary | ||

Except for Erlund, Haverinen and Talma, the executives are members of the Kesko Pension Fund's department A. Their retirement ages and pensions are determined based on the department's rules and each of their service contracts. Their retirement benefits are based on defined benefit plans. *If the President and CEO resigns, he is entitled to a 6-months' salary for the notice period. **TyEL = the Employees' Pensions Act. |

||||||

Risk management, internal control and internal audit

Risk management

Risk management is an integral part of management in Kesko

Kesko’s risk management is proactive and an integral part of its management and day-to-day activities. The objective of risk management is to ensure the delivery of customer promises in the Kesko Group, profit performance, dividend payment capacity, shareholder value, the implementation of responsible operating practices and the continuity of operations. Efficient risk management is a competitive advantage for Kesko.

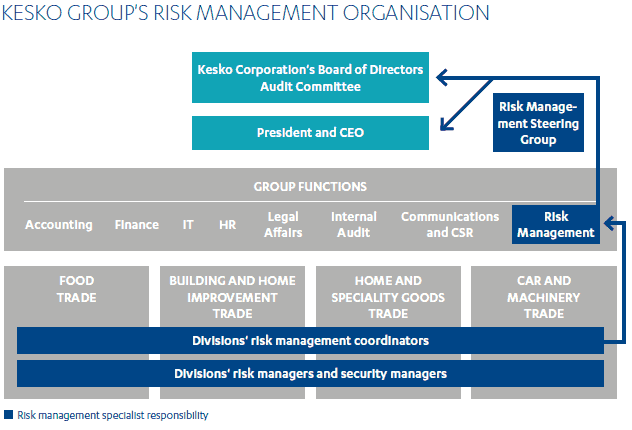

The risk management policy confirmed by the Board of Directors guides risk management in the Kesko Group. The policy is based on the COSO ERM Framework and the SFS-ISO risk management standard. The policy defines the objectives, principles, practices, organisation and responsibilities of risk management. Kesko divides risks into strategic, operational and financial risks.

In Kesko, a risk is defined as an event or circumstance

- that can hinder or prevent the attainment of Kesko's objectives, or

- that can lead to a failure to exploit business opportunities.

The Group has a uniform risk assessment and reporting system

The Kesko Group applies a business-oriented and comprehensive approach to risk assessment and management. This means that key risks are systematically identified, assessed, managed, monitored and reported as part of business operations at the Group, division, company and unit levels in all operating countries. Risk identification and assessment play a key role in Kesko's strategy work and rolling planning. In addition, risk assessments are made of significant projects related to capital expenditures or changes in operations.

Kesko has a uniform risk assessment and reporting system. Risk identification is based on business objectives and opportunities and the defined risk appetite. Risks are prioritised on the basis of their significance by assessing the impact and probability of their realisation and the level of risk management. All risks cannot or need not be managed. When assessing the impact of realisation, the impacts on reputation, employees' wellbeing and the environment are considered in addition financial impacts. Responsible persons are assigned to the planning, execution and monitoring of risk management responses. The defined responses are included in operating plans and monitoring.

Providing insurance cover is part of Kesko's risk management

Providing insurance cover is part of Kesko's risk management, and the policy confirmed by Kesko's Board of Directors defines the principles of providing insurance. The objective of insurance is to ensure that the Group's personnel, assets, business operations and liabilities have appropriate and economical insurance cover, while taking account of legislative requirements and the Group's risks and risk tolerance at any time. The Group's risk management function is responsible for the Group-level insurance programmes, their competitive tendering and brokerage services as part of the Group's damage/loss risk management.

Responsibilities and roles in risk management

The business division and Group function managements are responsible for risk management implementation. Each division has appointed a management board member, usually the finance director, to be responsible for coordinating risk management and security and providing guidelines in each respective division and reporting on risk management responses. In addition, divisions have risk managers and security managers, who are responsible for the development and control of risk management and security in the division, in cooperation with the business management and support functions.

Kesko has a Group-level Risk Management Steering Group, which is chaired by the Group's President and CEO, and composed of the representatives of the management of the various divisions and Group functions. The Group's risk management function controls and coordinates the development of joint risk management and security procedures, the adoption of best practices in the Group, and is responsible for risk reporting to the Group's management. Based on the divisions' and Group functions' risk analyses, the Group's risk management function prepares the Group's risk map, presenting the most significant risks and their management.

The Group's risk map, the most significant risks and uncertainties, as well as changes in and responses to them are reported to the Kesko Board's Audit Committee in connection with handling the interim reports and the financial statements. The Audit Committee's Chair reports on risk management to the Board as part of the Audit Committee report. Kesko's Board discusses the most significant risks and the responses required to control them, and assesses the efficiency of risk management. The most significant risks and uncertainties are reported to the market by the Board in the financial statements, and changes in them in interim reports.

The management of financial risks is based on the Group's finance policy, confirmed by Kesko's Board. Group Treasury is centrally responsible for funding, liquidity management, debt investor relations and the management of financial risks.

Risk management responses in 2011

Kesko's risk management policy was updated in late 2011 to take account of the SFS-ISO 31000 'Risk management – Principles and guidelines' standard. Kesko has an established risk management process and no significant changes took place in it in 2011.

The risk management function was closely involved in the project for the introduction of the new chip&pin payment terminals. This included the assessment of the introduction project and the risks of use, and the definition of new operating systems.

For the purpose of improving occupational safety, leveraging the results of the extensive inquiry for assessing risks at work carried out in 2009 was continued by assessing the identified risk factors in more detail and by determining location- or unit-specific responses to them.

With regard to damage/loss insurances, new forms of cooperation were sought and adopted jointly with business partners for the purpose of supporting proactive risk management work in Kesko. Competitive tendering of insurance broker services and the statutory workers' compensation insurance cover relating to Kesko's personnel in Finland was arranged.

Focus areas of risk management in 2012

As Kesko is strongly expanding its operating activities in Russia, local risk management resources will be increased and cooperation between the divisions as well as Group control will be added. Kesko’s risk management will continue to prevent damages and malpractice, to maintain and test continuity plans, and to provide cost-efficient insurance services. Competitive tendering for the Kesko Group's non-life insurances will be arranged early in the year.

The risk management function will continue working in close cooperation with other Group units, especially with the internal audit, legal affairs, human resources, accounting, treasury and IT functions in order to ensure the adoption of, for example, responsible operating practices, and to improve personnel safety and to develop risk management related to information security and data protection.

The most significant risks and their management responses

Risks and uncertainties impacting Kesko’s business operations and their management responses, as well as the organisation and principles of Kesko's risk management are described at www.kesko.fi/Investors and in the Report by the Board of Directors.

Financial risks (such as counterparty risk, liquidity risk, foreign exchange risk related to purchasing operations, interest rate risk and commodity risk relating to electricity derivatives) are described in accordance with the IFRS in note 39 to Kesko's financial statements for 2011.

Internal control

Internal control is a part of Kesko's manage-ment, governance and day-to-day opera-tions. The Board and the President and CEO are ultimately responsible for the organisa-tion of internal control. The Audit Committee of Kesko's Board has confirmed Kesko's internal control policies, which are based on good control principles, widely accepted internationally (COSO).

Internal control refers to all proactive operations, daily and subsequent control, aimed at ensuring the achievement of business objectives. Kesko's values, operating principles and the company's strategy and objectives form the basis of internal control as a whole. Kesko's operating principles have been communicated to the Kesko employees in the guide 'Our Responsible Working Principles' and the related Group-wide training programme.

Daily controls include working instructions and system and manual controls, as well as the definition and differentiation of responsibilities and powers, job specifications, approval authorisations and substitute procedures as well as financial and other reporting. The Kesko Group's internal audit function evaluates and verifies the efficiency of internal control and assists management and the companies in the development of an internal control system.

The objective of internal control in the Kesko Group is to ensure profitable and effective operations, to secure the continuity of operations, reliability of financial and operational reporting, compliance with laws and agreements and Kesko's values and operating principles as well as the security of assets and information.

Internal audit

Kesko's internal audit function is responsible for the Group's independent evaluation and assurance function required of a listed company, which systematically examines and verifies the efficiency of risk management, control, management and governance. The Audit Committee of Kesko's Board has approved the internal audit function's operating instructions.

Organisation and operations of the internal audit function

The internal audit function is organised under Kesko's President and CEO and the Audit Committee, and it reports on its findings and recommendations to the Audit Committee, the President and CEO, the management of the audited operation, and the auditor. The function covers all of Kesko's divisions, companies and functions.

Auditing is based on risk analyses and risk management and control discussions with the Group's and divisions' managements. Meetings with the auditor are also arranged on a regular basis. An internal audit plan, subject to approval by the President and CEO and the Audit Committee, is prepared annually. The annual plan is modified on a risk basis, if necessary.

As necessary, the internal audit function purchases external services for added resources or for the purpose of conducting audit operations which require special competences. Audits can also make use of the competence and work contribution of the Kesko Group's other specialists.

The internal audit function cooperates with the Group's risk management function and participates in the work of the Risk Management Steering Group. The internal audit function assesses the efficiency of Kesko's risk management system annually.

Internal audit operations in 2011

In 2011, the areas of emphasis of the internal audit function included foreign operations and information system audits. The audits of foreign operations concentrated on the implementation of changes in business operations, selections management, and the other basic controls of purchasing. In information system audits, special attention was paid to systems projects in progress, continuity and information security. Compliance with Kesko's accounting policies and reporting guidelines was verified and assessed in various audits. The audits increasingly leveraged data extraction and analysing software. For the purpose of developing auditing, an external quality assurance evaluation on the internal audit was carried out. Close cooperation with the auditor was strengthened.

Focus areas of internal audit in 2012

The emphasis in the audit operations of the internal audit function in 2012 will be on the expansion of business operations in Russia and the related risks, as well as on significant business and IT projects. Other focus areas include purchasing controls, risks of malpractice, HR governance, IT governance, data security, continuity of operations and electronification of processes.

Outline of internal control and risk management systems related to the Group’s financial reporting

Kesko’s management system

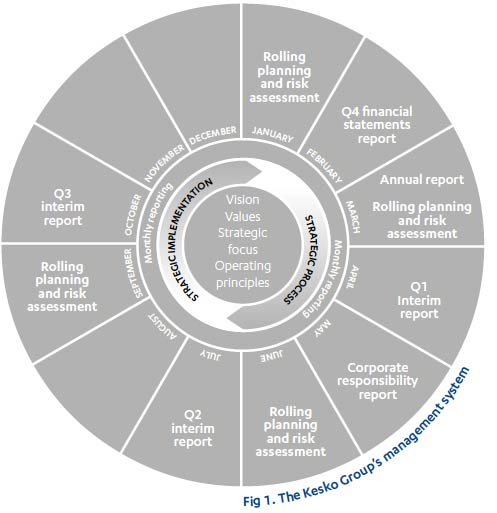

Kesko’s financial reporting and planning are based on the Kesko Group’s management system. The Group units’ financial results are reported and analysed within the Group on a monthly basis, and disclosed in interim reports published quarterly. Financial plans are prepared for quarterly periods, in addition to which significant changes are taken into account in the monthly performance forecasts. The Group’s and its units’ strategies and related long-term financial plans are updated annually.

Roles and responsibilities

The Kesko Group’s financial reporting and its control is divided between three organisational levels. The subsidiaries analyse and report their figures to the respective divisions, which then report the division-specific figures to Corporate Accounting. Analyses and controls for ensuring the accuracy of reporting are used at each level.

The accuracy of reporting is ensured by using different automated and manual controls at every reporting level. In addition, the income statement and balance sheet are analysed by controllers at subsidiary, division and Group level every month. The implementation of the analyses and controls is supervised on a monthly basis at company, division and Group level.

Planning and performance reporting

The Group’s financial performance and the achievement of financial objectives are monitored via Group-wide financial reporting. Monthly performance reporting includes Group, division and subsidiary specific results, changes compared to the previous year, comparison with financial plans, and forecasts for the next 12 months. The Group’s short-term financial planning is based on plans drawn up by the quarter, extending for the following 15 months. The financial indicator for growth is sales performance, while that for profitability is the accumulation of economic value added, monitored via monthly internal reporting. In the calculation of economic value added, the requirements concerning return on capital are determined annually on market terms, and the return requirements take account of risk-related division and country specific differences. Information on the Group’s financial situation is communicated in interim reports and the financial statements release. The Group’s sales figures are published in a stock exchange release each month.

Financial planning takes place at the subsidiary, division and the Group level as rolling plans, each for a 15-month period, are made. The plans are updated quarterly, and any significant changes are taken into account in the performance forecasts reported monthly. Any deviations between the plan and the actual result are analysed by the company, division and Corporate Accounting, and the reasons are reported to the division and Corporate Accounting every month.

The performance reports provided monthly for the Group’s top management comprise the subsidiaries’, divisions’ and the consolidated income statements and balance sheets. Each subsidiary is primarily responsible for the financial reporting and the accuracy of its figures. The financial management and the controlling function of each division analyse the respective division’s figures, while Corporate Accounting analyses the whole Group’s figures. The income statement and the balance sheet are analysed monthly at the company, division and Group level, based on the documented division of duties and specified reports. This enables a real-time knowledge of the financial situation, as well as real-time response to possible defects. The performance reports provided for the top management also include Group level monitoring of sales on a weekly, monthly and quarterly basis.

Public performance reporting comprises interim reports, the financial statements release, annual financial statements and monthly sales reports. The same principles and control methods are applied to the public performance reporting as to the monthly performance reporting. The Audit Committee reviews the interim report and the financial statements and gives a recommendation on their approval to the Board of Directors. The Board of Directors approves each interim report and the financial statements before they are published.

Key actions in 2011

The Kesko Group continued the project for harmonising the financial management information systems, which will serve both the Group companies and the K-Group's retailers. The resulting financial management system will be part of the Group's financial reporting system. In addition, the K-Group's financial management processes and the control environment will become uniform.

The adoption of a shared planning system, which was begun earlier, was continued. The project will harmonise the Group companies' planning systems and integrate them in the Group's reporting system.

Auditors' fees in 2010–2011 (€, thousand) |

|||||||||||

| 2011 | 2010 | ||||||||||

| PwC | Other audit firms | Total | PwC | Other audit firms | Total | ||||||

| Kesko Corporation |

Other Group companies |

Kesko Corporation |

Other Group companies |

Kesko Corporation |

Other Group compa- nies |

Kesko Corporation |

Other Group compa- nies |

||||

| Auditing | 76 | 758 | - | 59 | 892 | 106 | 828 | - | 59 | 993 | |

| Tax consultation | 54 | 68 | 4 | 13 | 139 | 84 | 31 | - | 17 | 132 | |

| IFRS consultation | 11 | - | 4 | - | 15 | 3 | - | 2 | - | 5 | |

| Other services | 96 | 269 | 30 | 57 | 452 | 59 | 64 | 54 | 28 | 205 | |

| Total | 237 | 1 095 | 38 | 129 | 1 498 | 252 | 923 | 56 | 104 | 1 336 | |

Key actions in 2012

In 2012, the financial management function will continue the information system project serving the K-Group and its adoption.

Accounting policies and financial management IT systems

The Kesko Group has adopted the Interna-tional Financial Reporting Standards (IFRSs) endorsed by the European Union. The accounting policies adopted by the Group are included in the accounting manual, updated as the standards are amended. The manual contains guidelines for separate companies, the parent company, and guidelines for the preparation of consolidated financial statements.

The Kesko Group’s financial management information is generated by division-specific enterprise resource planning systems, via a centralised and controlled common interface, into the Group’s centralised consolidation system, to produce the Group’s main financial reports. The key systems used in the production of financial information have been certified and secured by back-up systems, and they are controlled and checked regularly to ensure reliability and continuity.

Audit

According to the Articles of Association, Kesko has one auditor, which shall be an audit firm authorised by the Central Chamber of Commerce. The Audit Committee prepares a proposal for the company's auditor to the General Meeting. The Audit Committee also evaluates the auditors' operations and services annually. The term of an auditor is the company’s financial period and an auditor’s duties terminate at the close of the Annual General Meeting following the election. As a rule, a network firm of the audit firm represented by the auditor elected by Kesko's General Meeting acts as the auditor of the Group's foreign subsidiaries.

The 2011 General Meeting elected PricewaterhouseCoopers Oy, Authorised Public Accountants, as the company's auditor, with APA Johan Kronberg as the auditor with principal responsibility. The General Meeting resolved that the auditor's fee is paid and expenses are reimbursed according to invoice approved by the company.

OTHER INFORMATION

OTHER INFORMATION

More comprehensive information on Kesko's Corporate Governance and the separate statements referred to in the Corporate Governance Code, Kesko's Corporate Governance Statement and the Remuneration Statement are available in the Investor section at www.kesko.fi/en.

Kesko among the best in Corporate Governance reporting

In the spring 2011, Kesko was awarded by World Finance Magazine as the best in Finland in terms of Corporate Governance development and reporting. In the competition for the best corporate governance reporting, organised in the spring 2011 in Finland, Kesko was ranked among the best three in the category of large listed companies. Kesko's remuneration statement received the best assessment from the jury of the competition. Kesko's description of risk management, internal control and internal audit was given credit for being clear, transparent, high-quality and up-to-date.